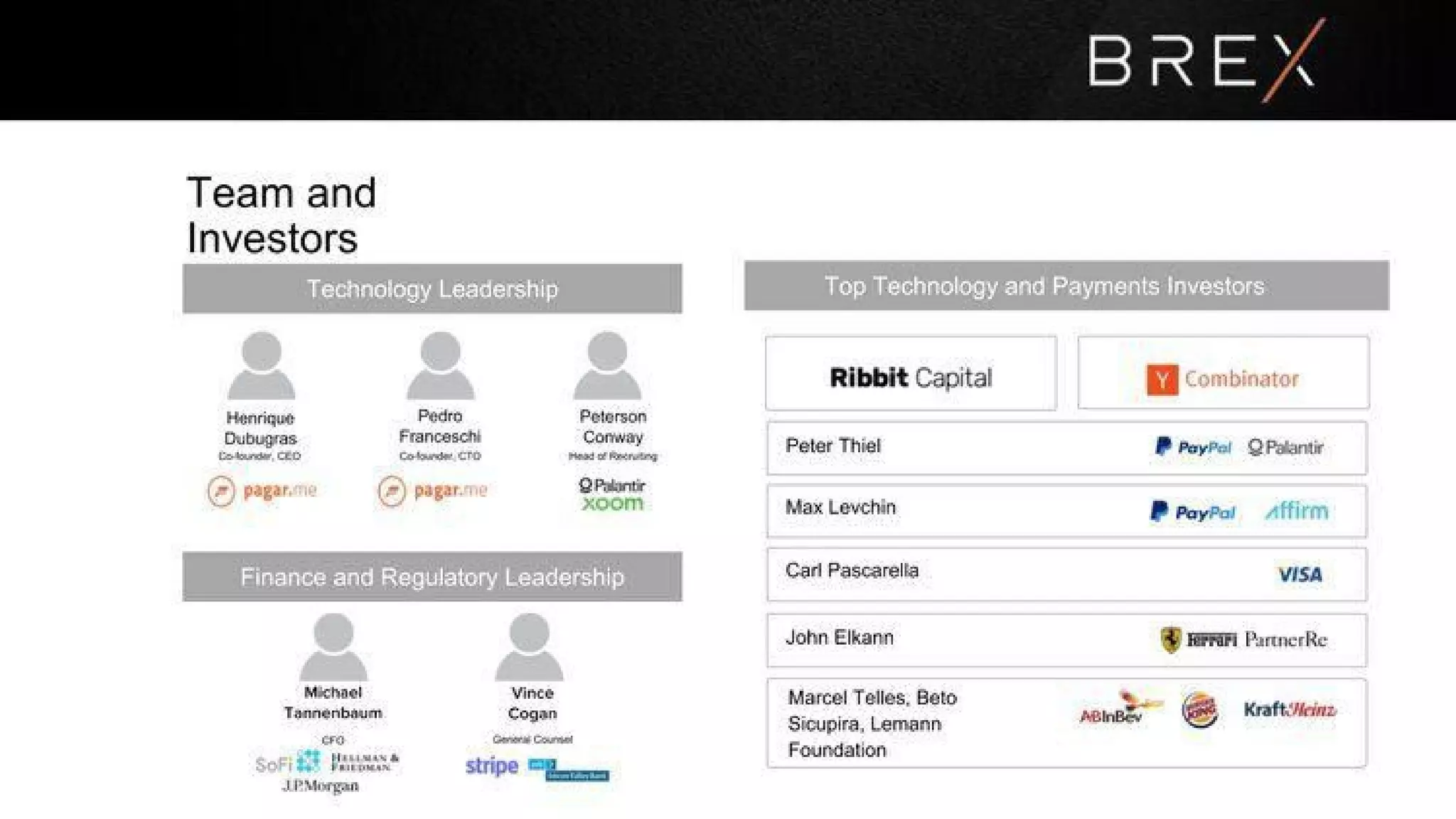

Team and investor credibility

Slide 2 opens with the leadership and investor roster, a classic trust-building move for a capital-intensive fintech. The slide calls out the founders' payments and technology backgrounds and places high-profile payments and fintech investors (Ribbit, YC, Peter Thiel, Max Levchin, Visa, etc.) on the right — this signals both domain expertise and strong syndicate validation. For investors evaluating risk in a regulated, partner-dependent business like corporate cards, this visual shorthand reduces friction: it shows the company has both product/technical chops and access to payments and regulatory advice.

Founders can learn from the economy of this slide: place credibility up front if your business depends on partnerships, regulatory relationships, or non-obvious domain expertise. Use logos and succinct role callouts rather than long bios — it’s faster to absorb and helps anchor later claims about underwriting, bank relationships, and operations.