Opening & Proof of Traction

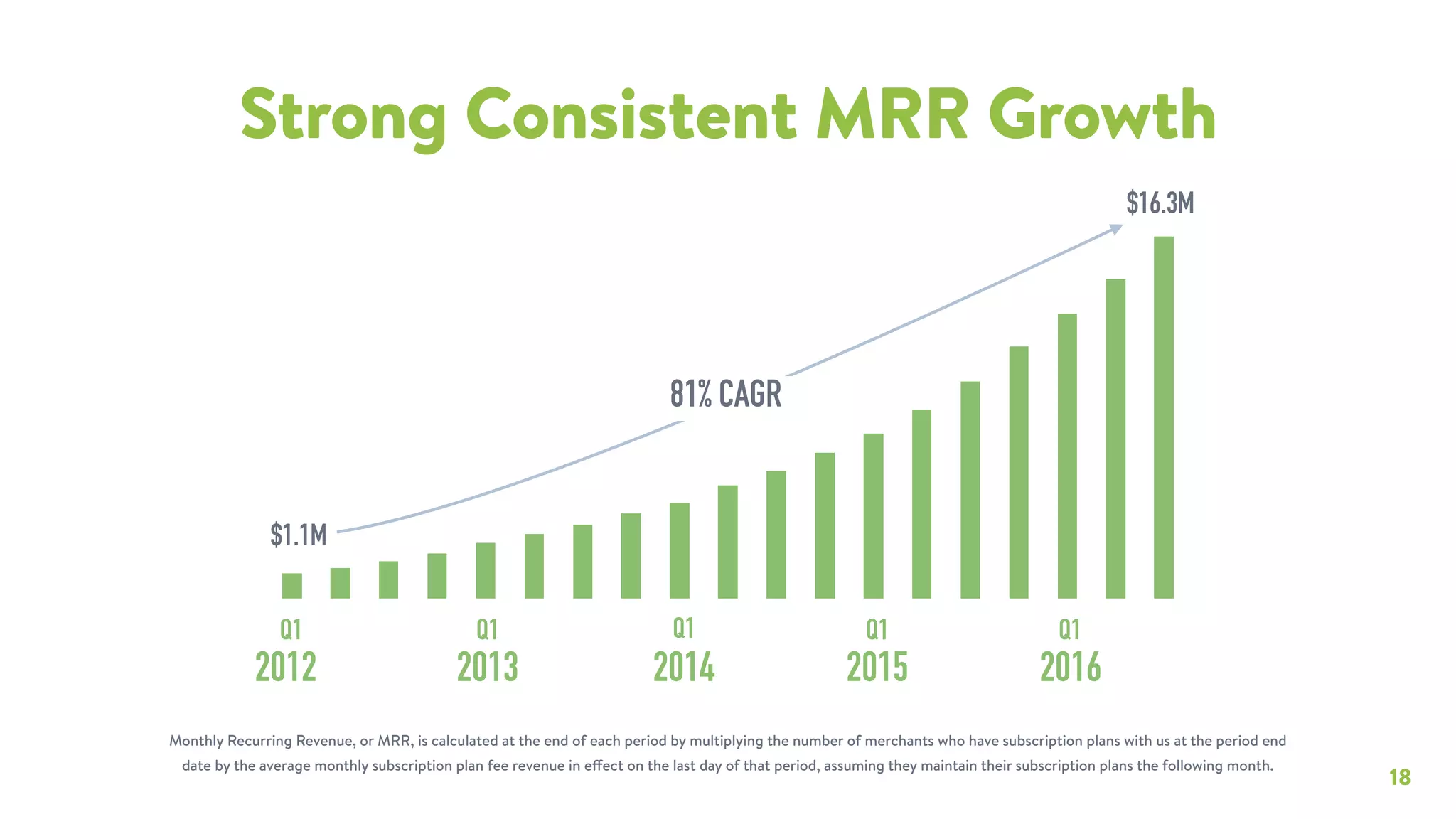

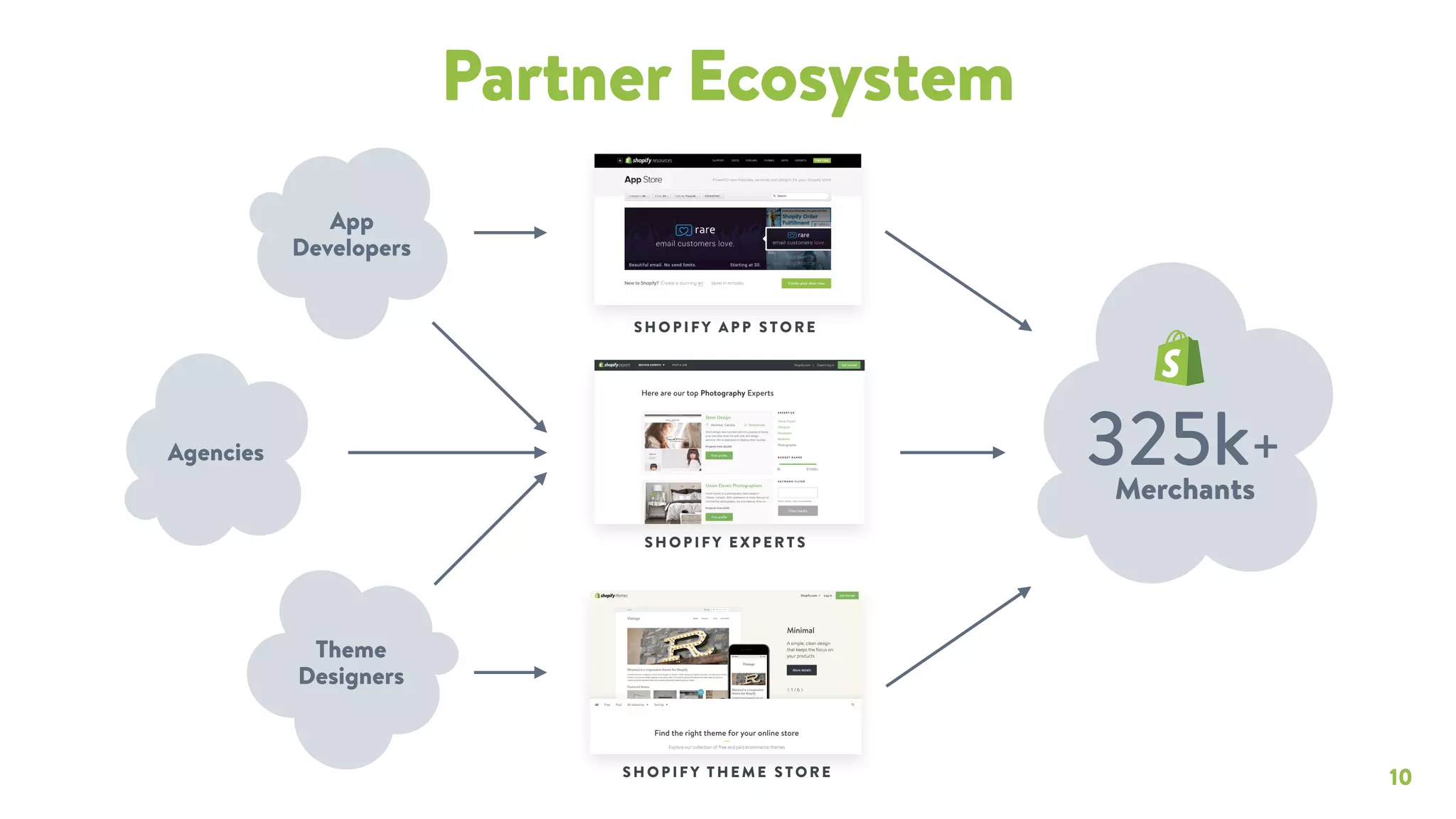

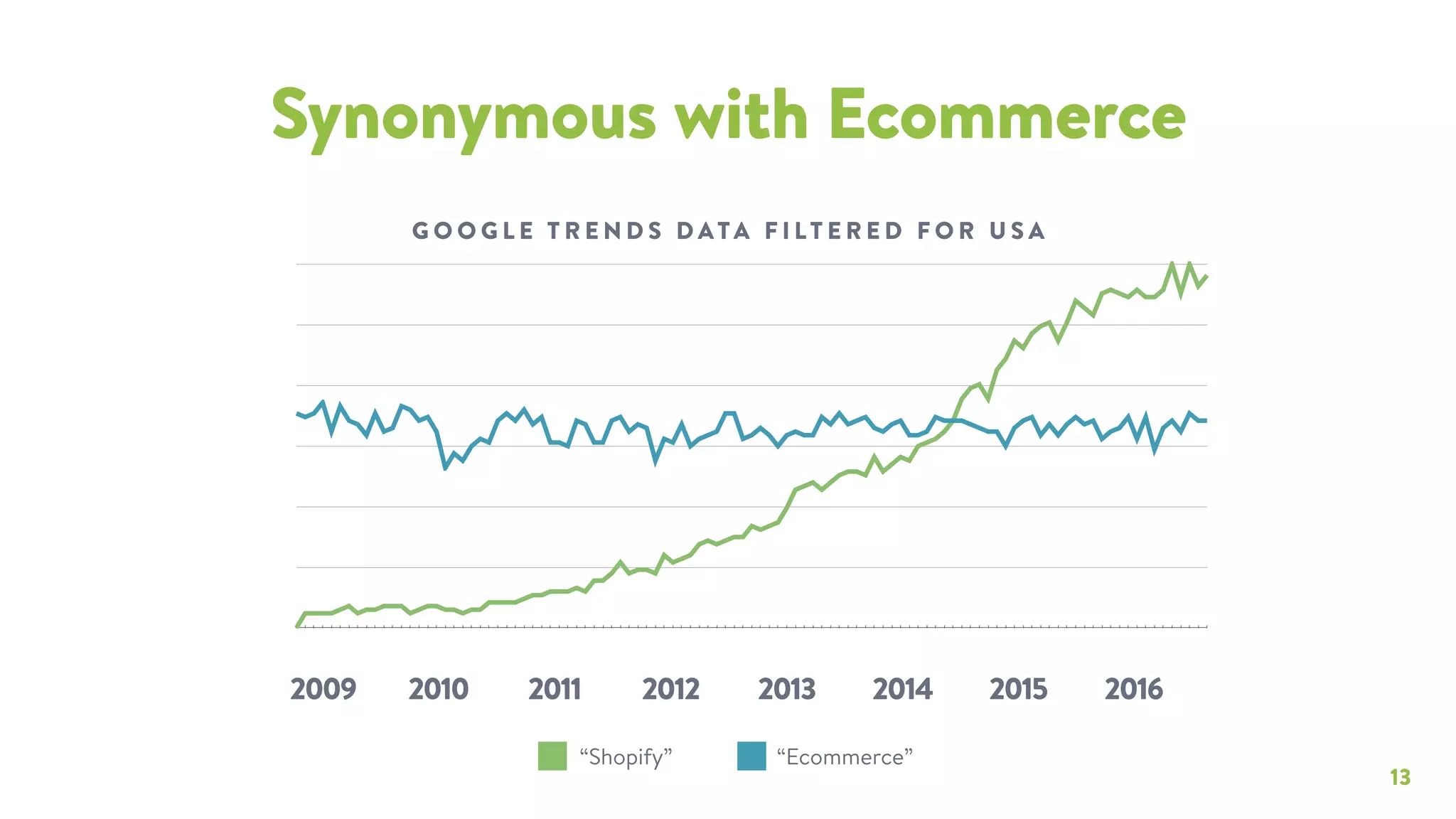

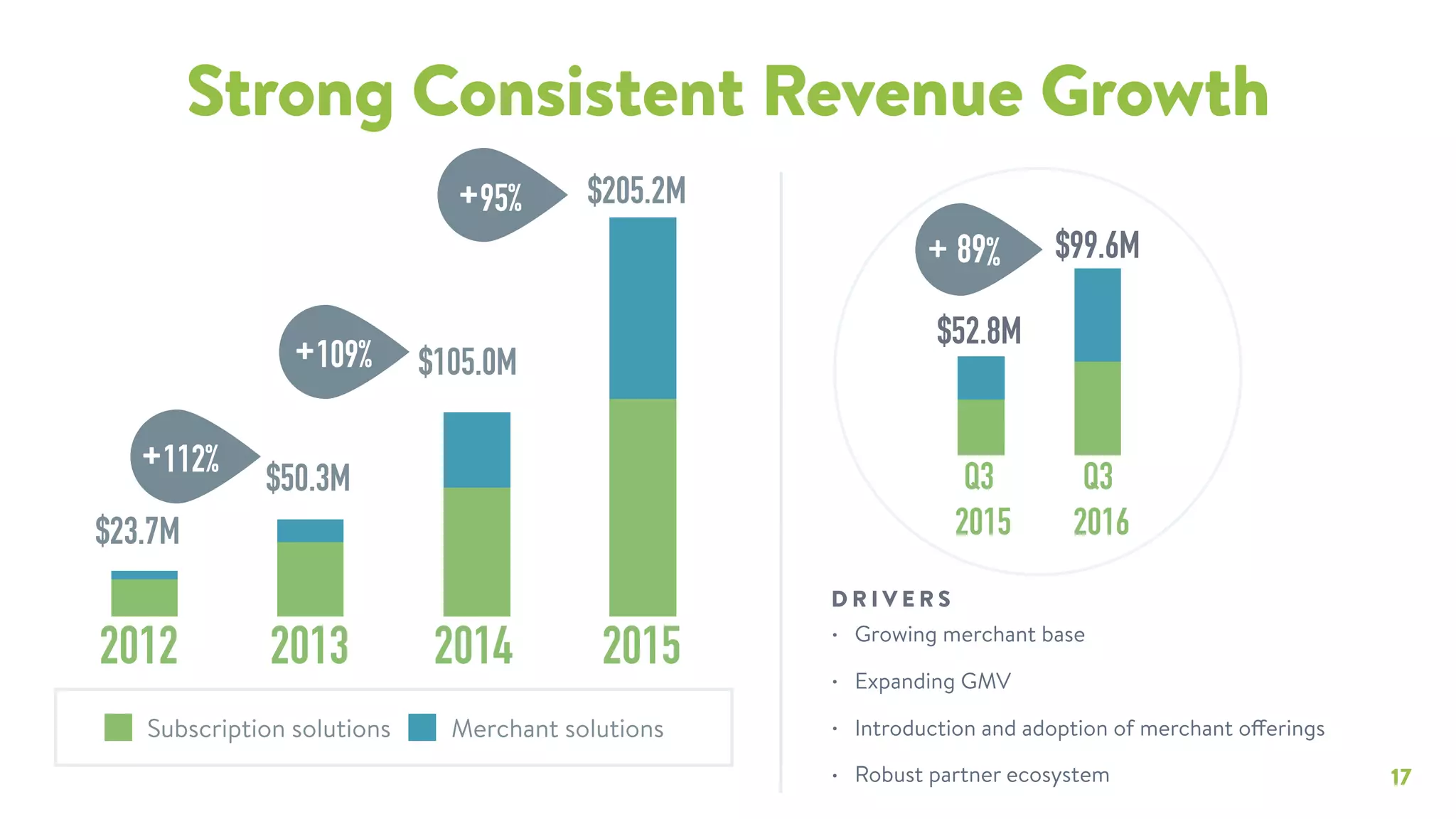

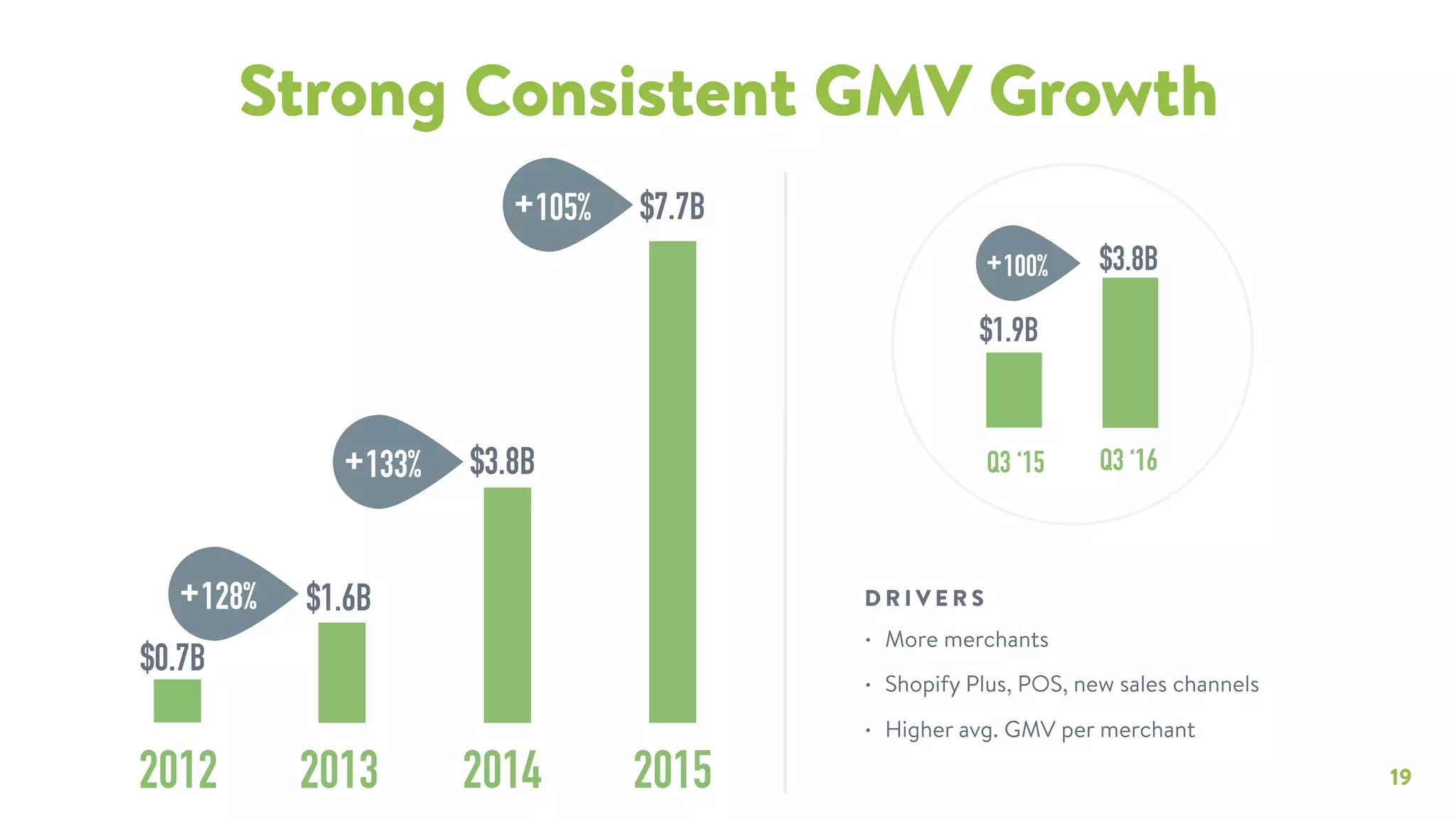

The first slide (branding + headline metrics) leads with the Shopify logo and immediately surfaces two high-impact stats: 325,000+ active merchants and $3.8B+ GMV in Q3 2016. This is classic social-proof-first framing: before diving into product details, the deck demonstrates market validation and scale. It signals to investors that the company has already achieved meaningful usage and a large economic flywheel, shifting the conversation from speculative product/market fit to scaling and monetization.

Visually the slide is restrained and professional — large numbers, large whitespace, and an aspirational product shot. Founders can learn to front-load the most compelling evidence of traction (user counts, GMV/revenue milestones) so investors immediately understand where the business sits in its lifecycle. The use of concrete, verifiable metrics builds credibility and primes the audience for deeper metrics later in the deck.