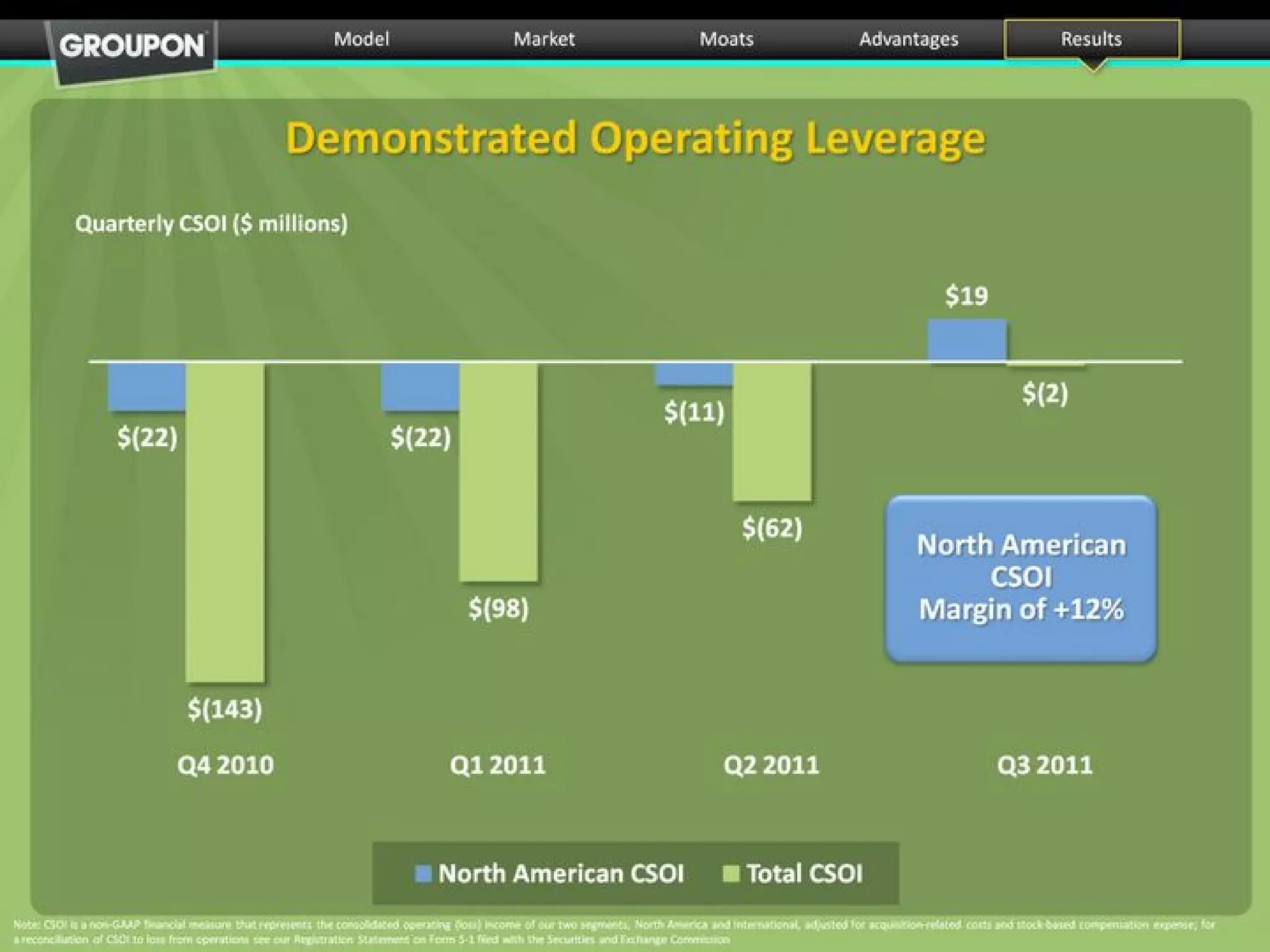

The Opening: Clear brand and framing

Slide 1 is a clean title slide that immediately establishes brand identity and the purpose of the presentation (Initial Public Offering). It uses large, legible typography and a single month/year date to set the time-context — an effective way to orient investors without noise. The design choice (simple, green, strong logo) signals confidence and continuity between consumer product and corporate story.

Founders should note how the slide sets a professional tone quickly. For investor-facing decks, your first slide should do less than you think: brand + purpose + date is often enough. Avoid clutter; the goal is to create a consistent visual identity that carries through the entire presentation so that subsequent slides feel like parts of one integrated story.