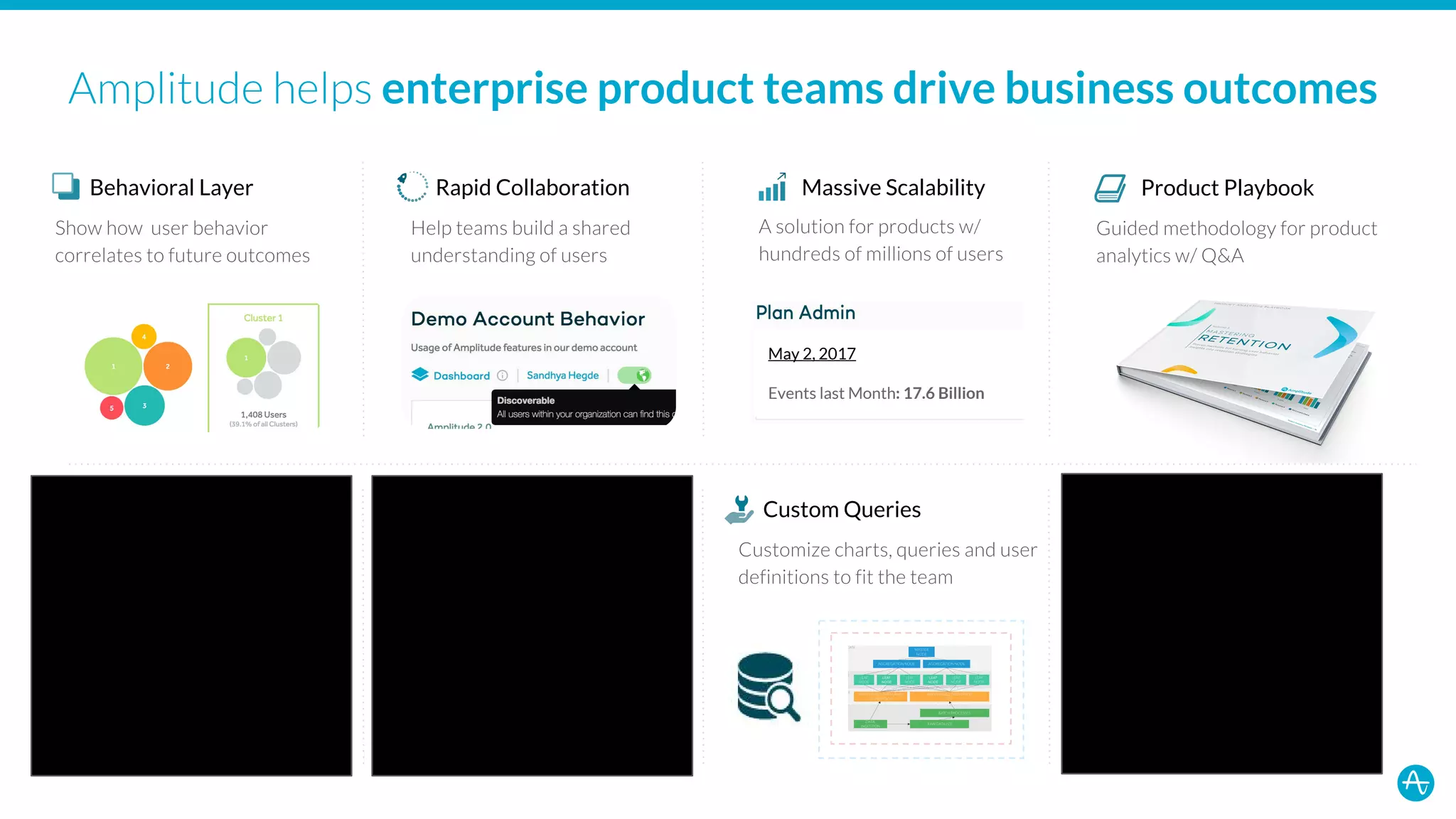

The Opening: Strong branding and a clear mission

Slide 1 is a classic example of how to open a deck: single, clean visual with the logo, a short, memorable tagline (“Build Better Products”), and a date. The slide sets tone and audience expectations without distracting details — investors immediately know this is a product-focused company and that the deck will be about enabling product teams. The background cityscape and consistent color palette also establish brand identity and professionalism.

Founders can learn from this restraint: a title slide should establish the mission and brand cadence, not cram in metrics or team bios. That one-line mission gives the rest of the presentation a through-line, so every subsequent slide can be judged against whether it helps teams “build better products.”