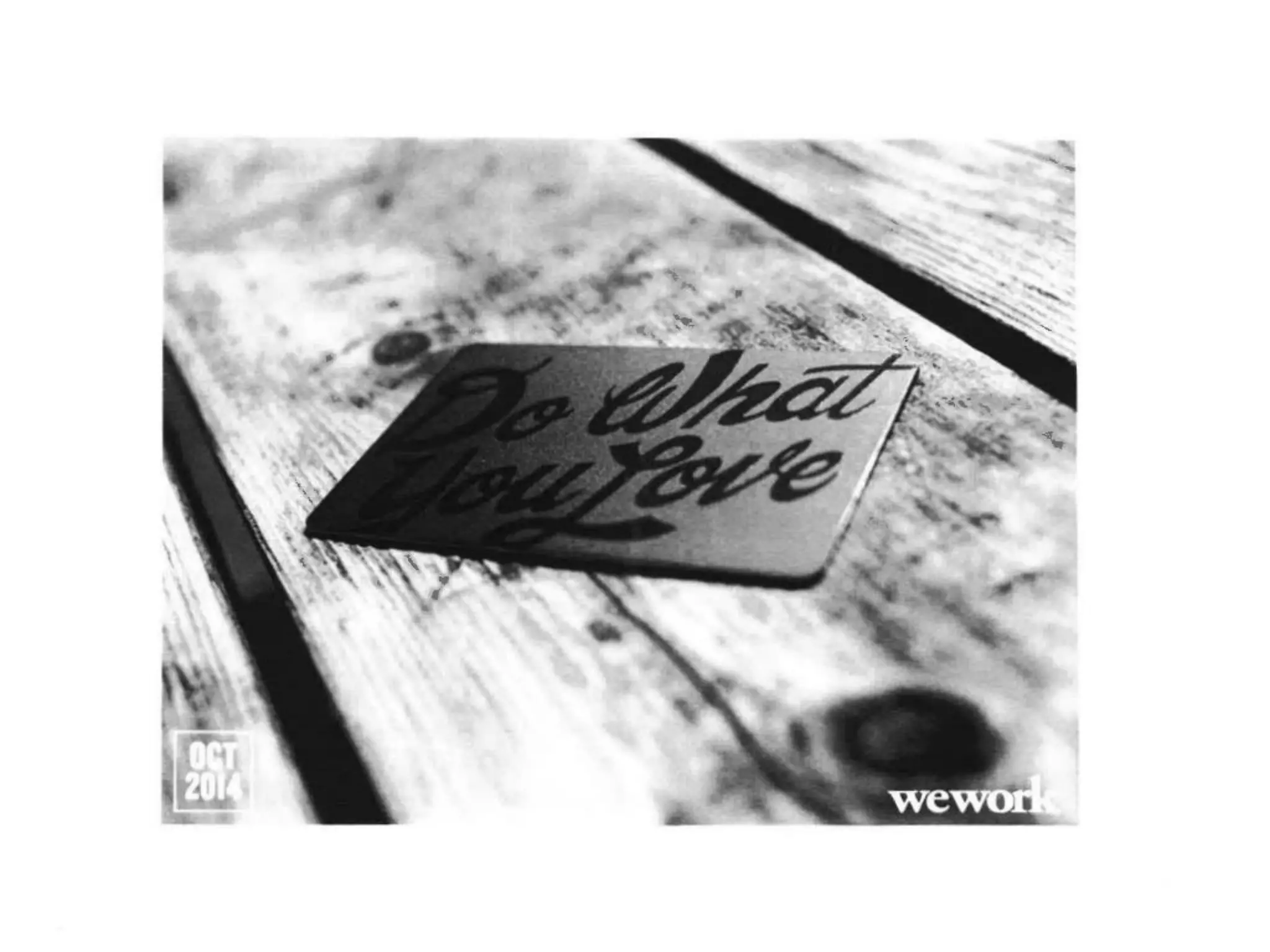

Opening & Brand Positioning: Emotion first

Slide 1 is a single-image opener that sets tone more than data: a monochrome photograph with the phrase “Do What You Love,” and subtle branding. It uses emotion to create immediate alignment with the audience (investors who respond to mission-driven narratives) and primes viewers to see the product as cultural rather than purely functional. This is effective at capturing attention and framing the deck’s thesis around lifestyle, community and identity rather than just square footage or lease terms.

Founders can learn the power of a purposeful opener: a short, memorable, emotionally resonant visual that supports the company’s differentiator. However, this kind of opener works best when followed quickly by crisp evidence — growth, unit economics and defensibility — because strong emotion can otherwise obscure important operational risks.