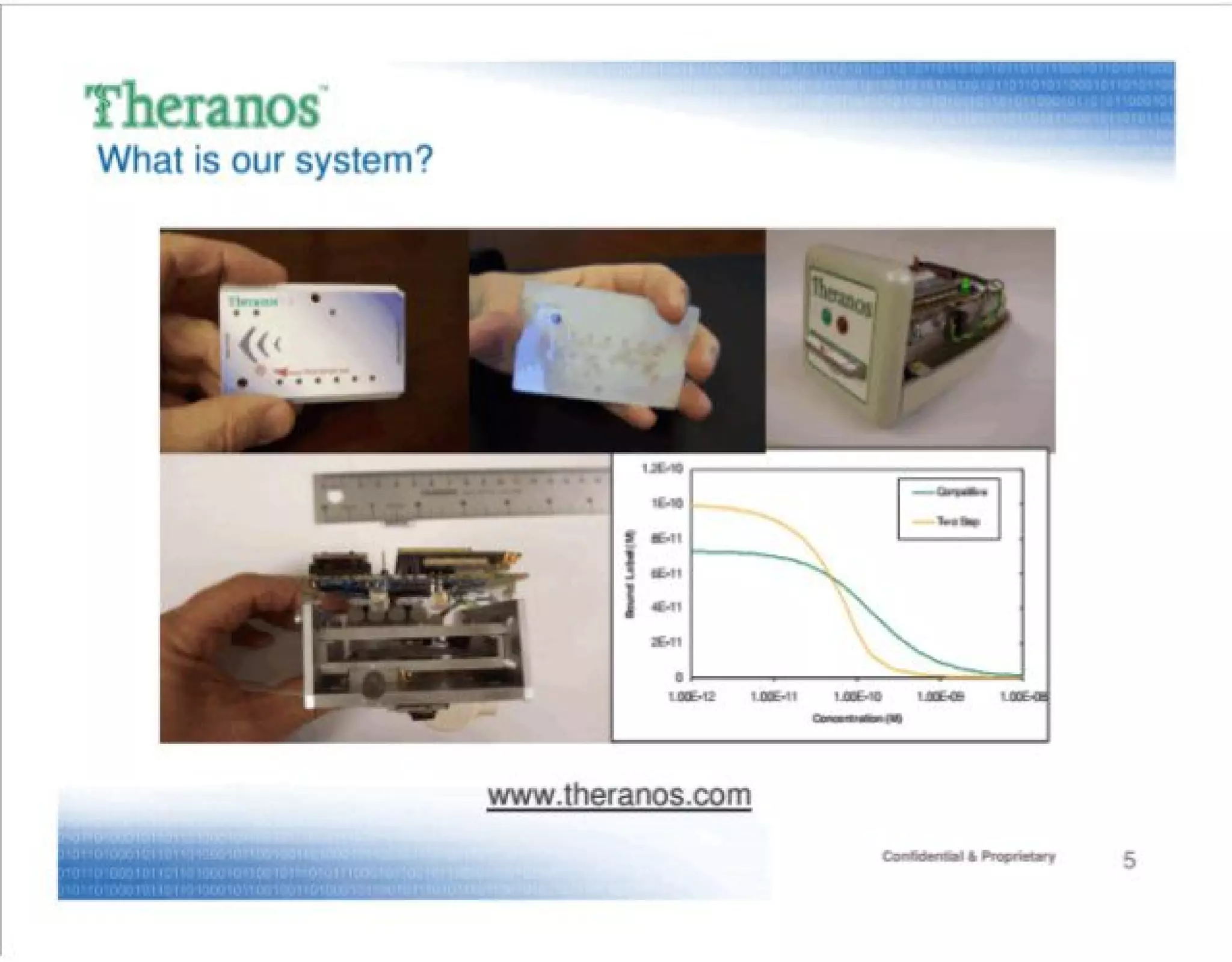

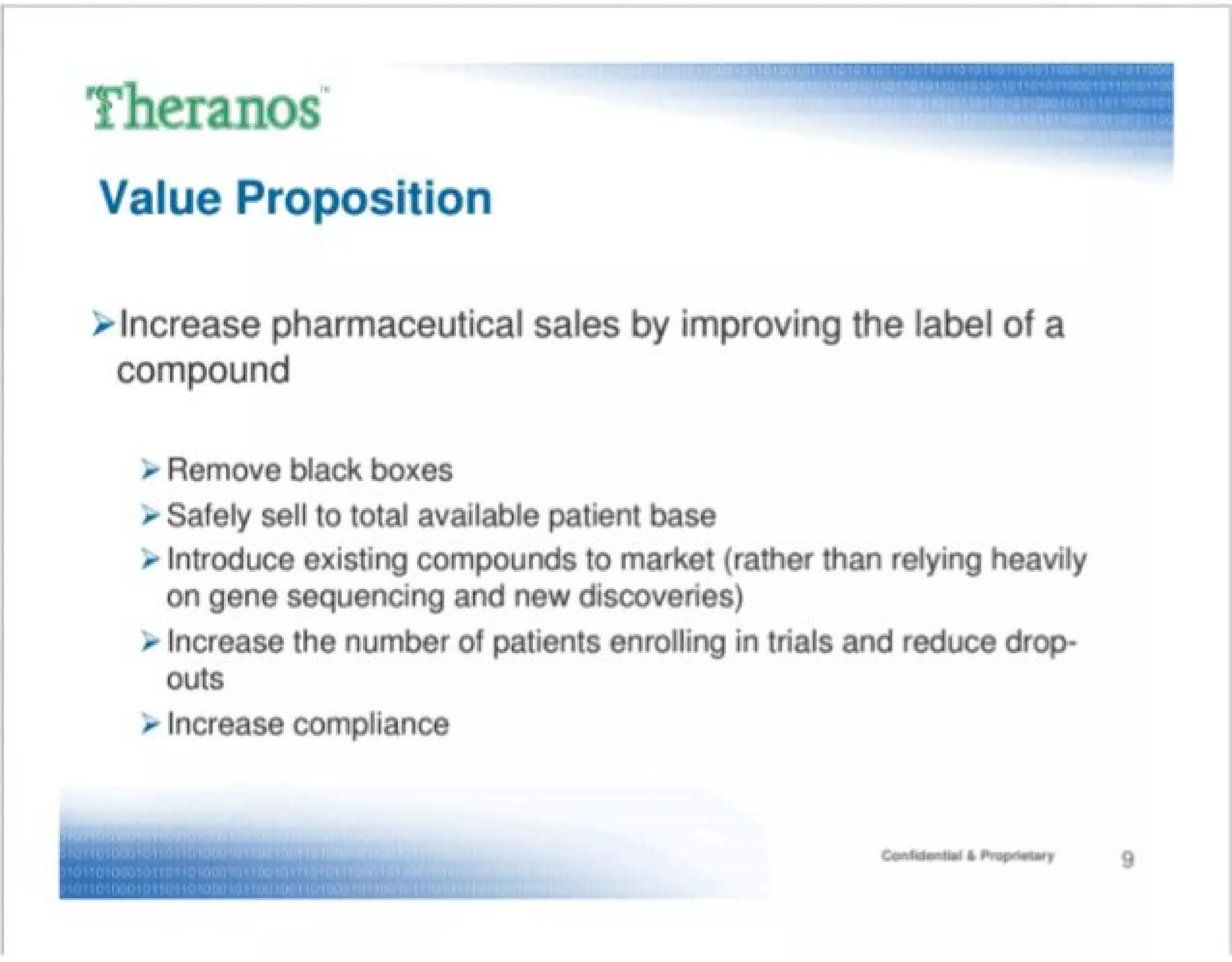

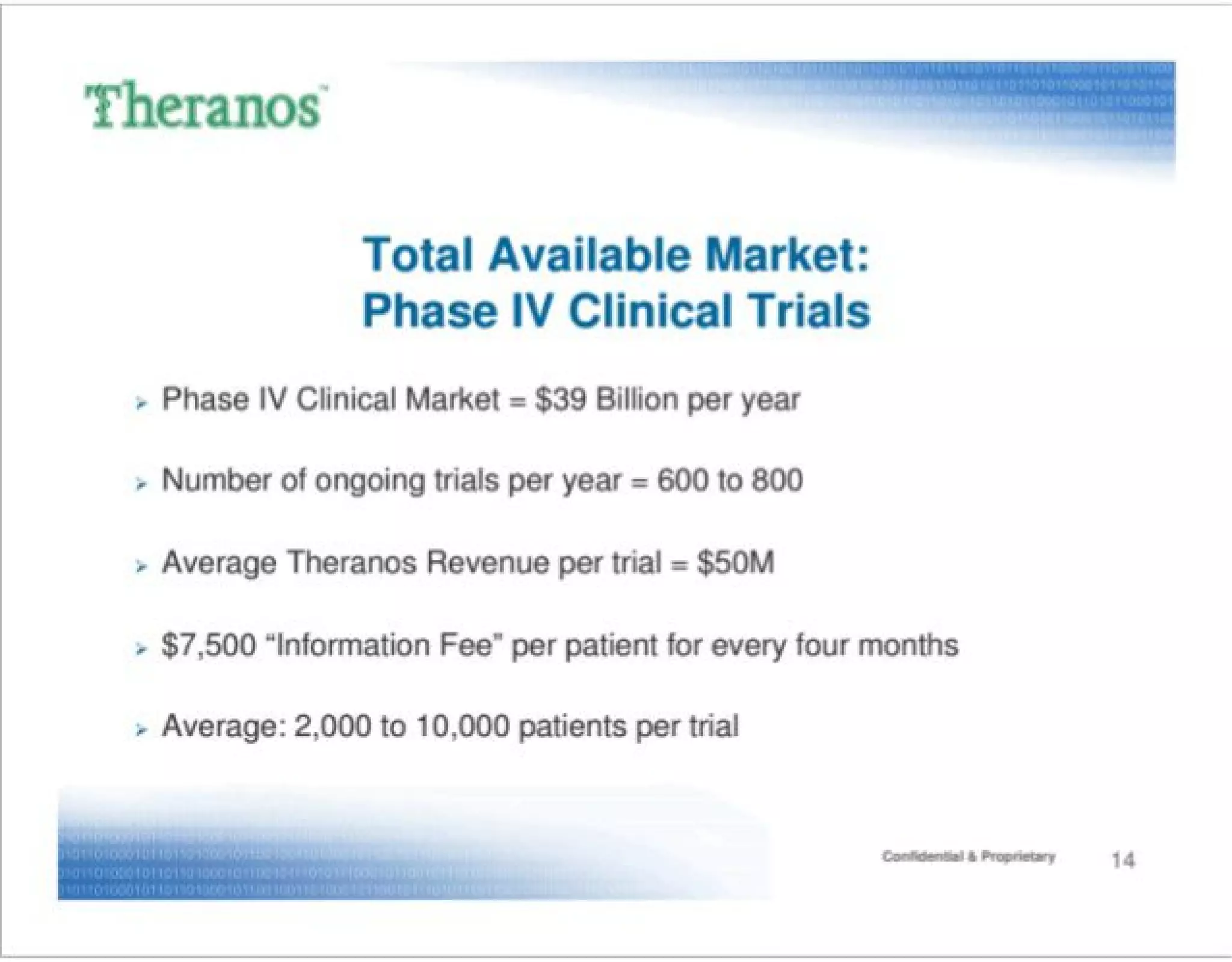

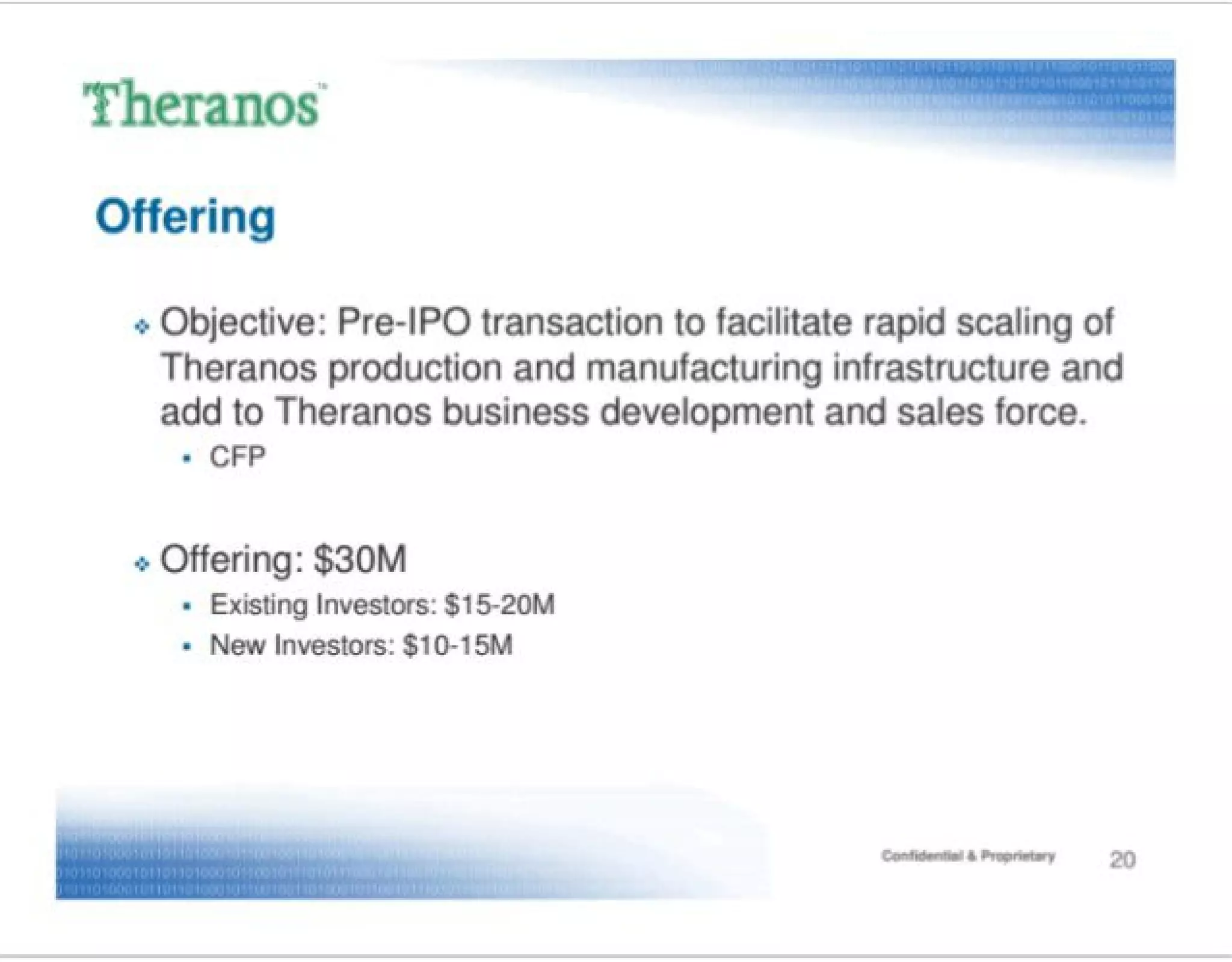

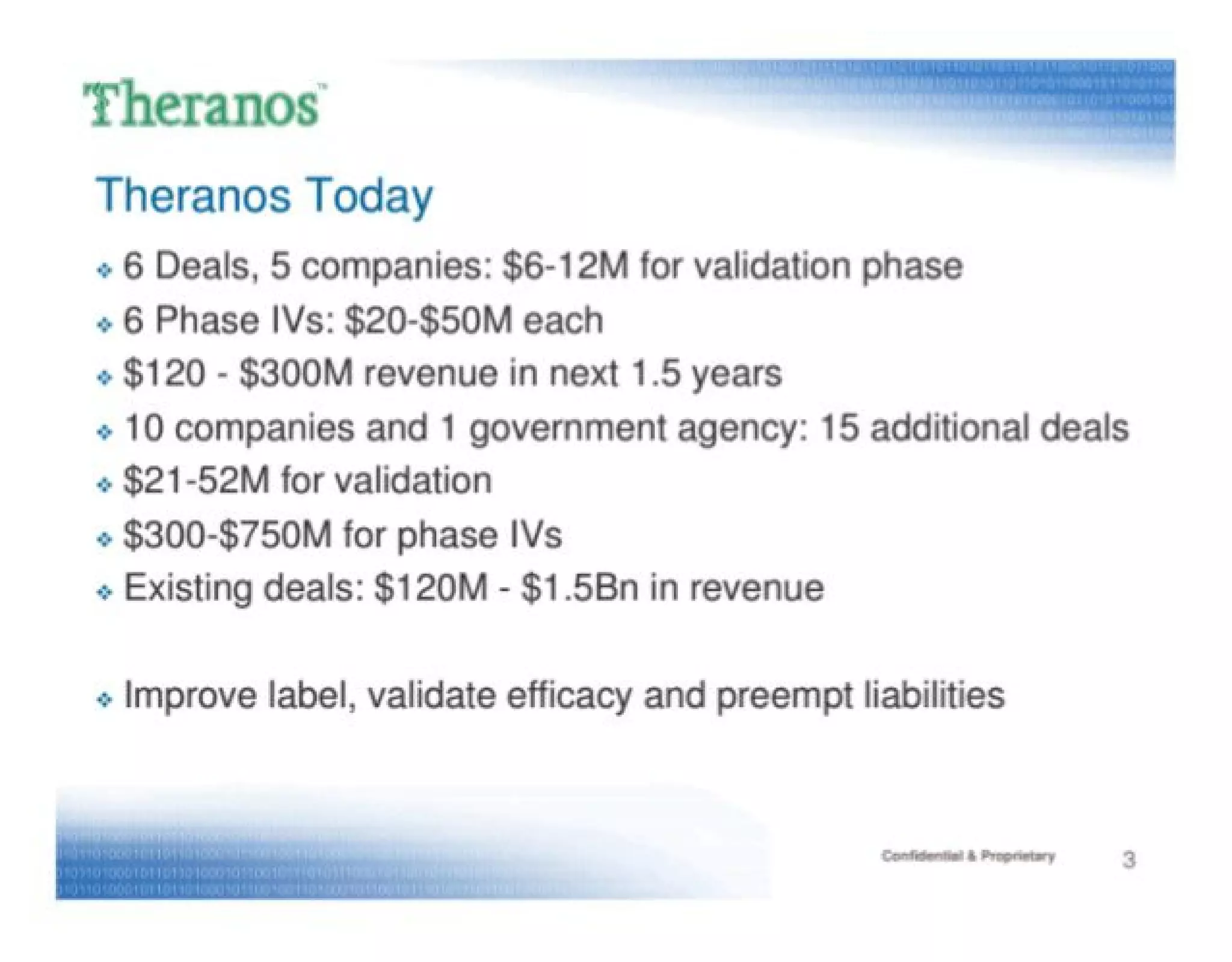

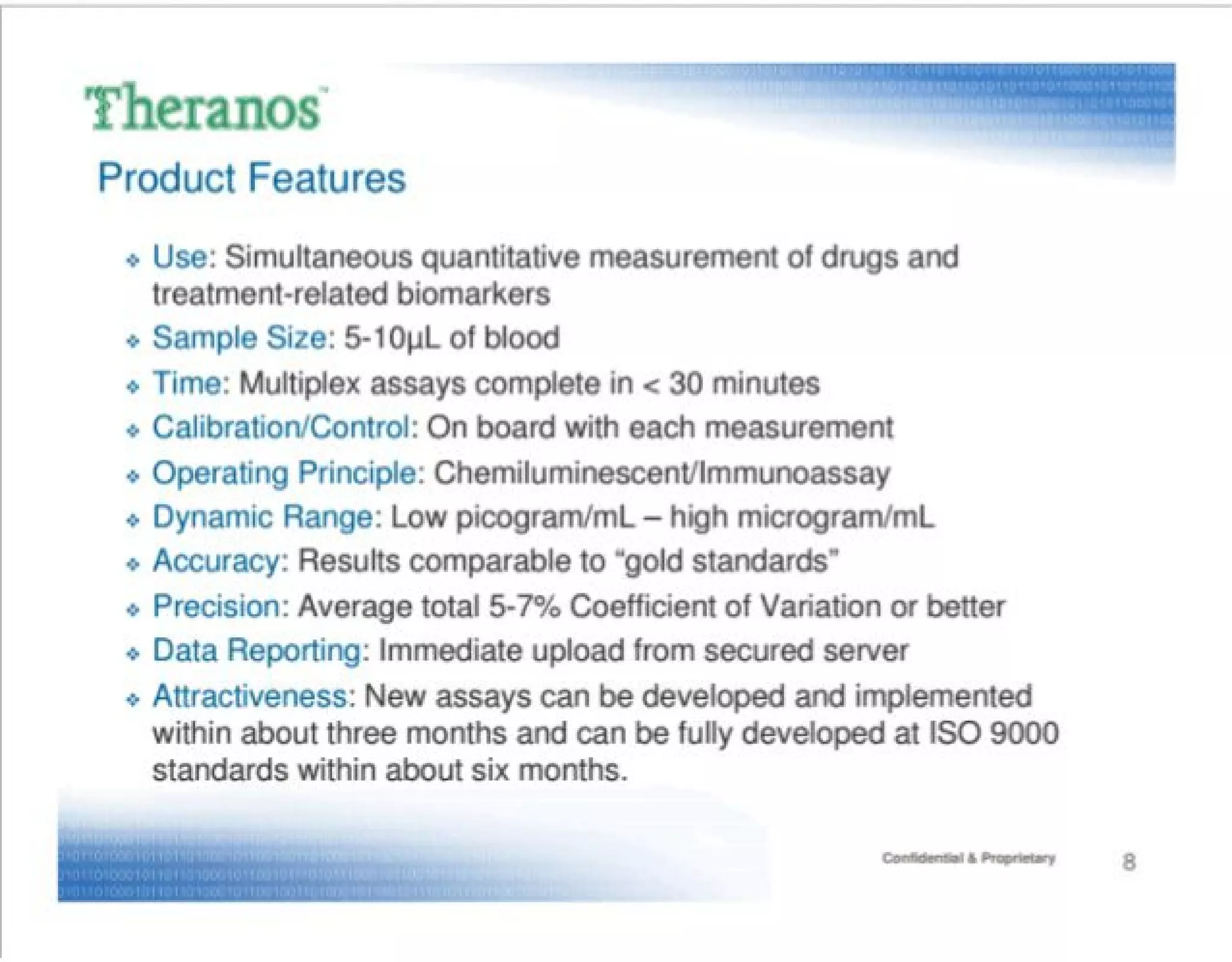

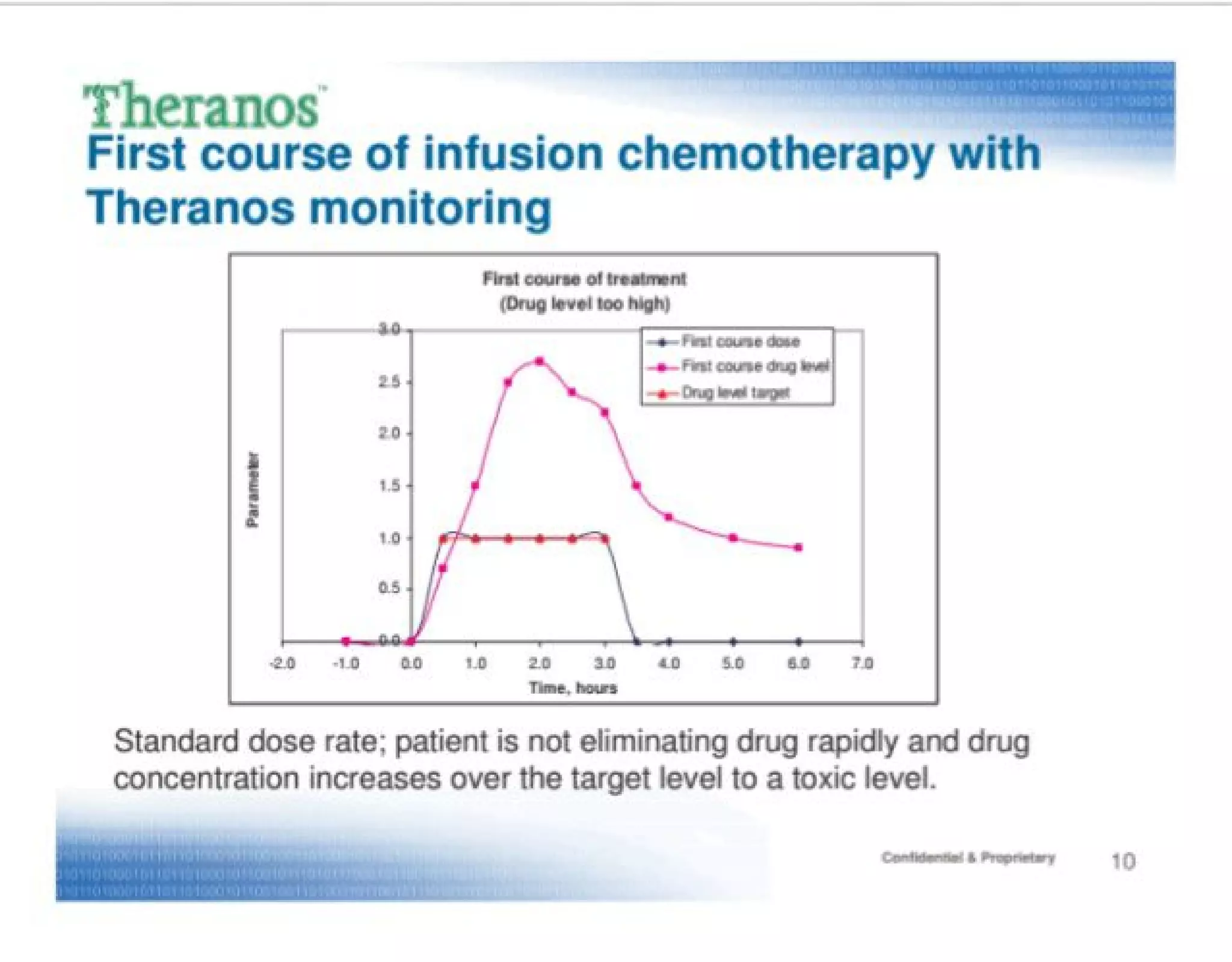

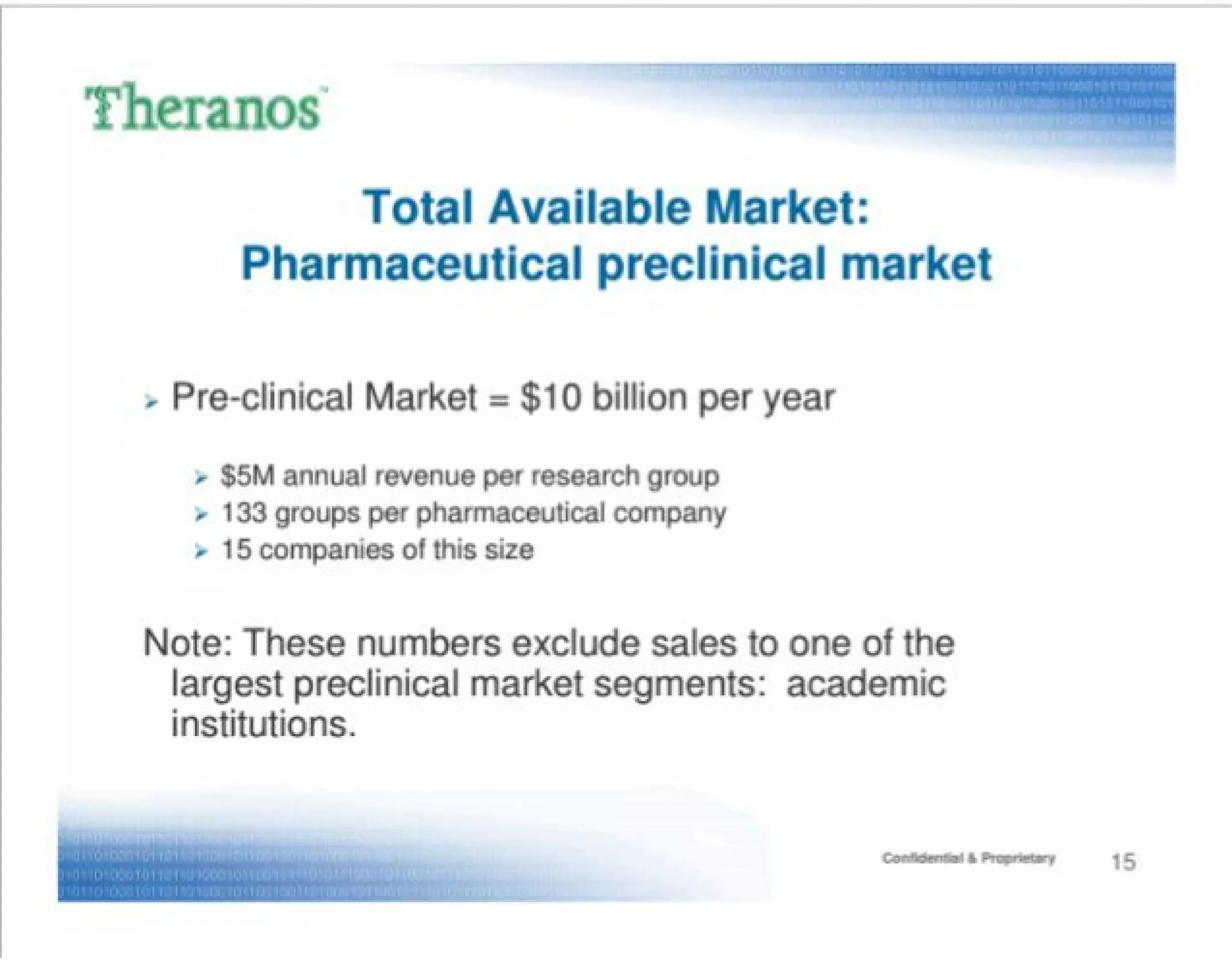

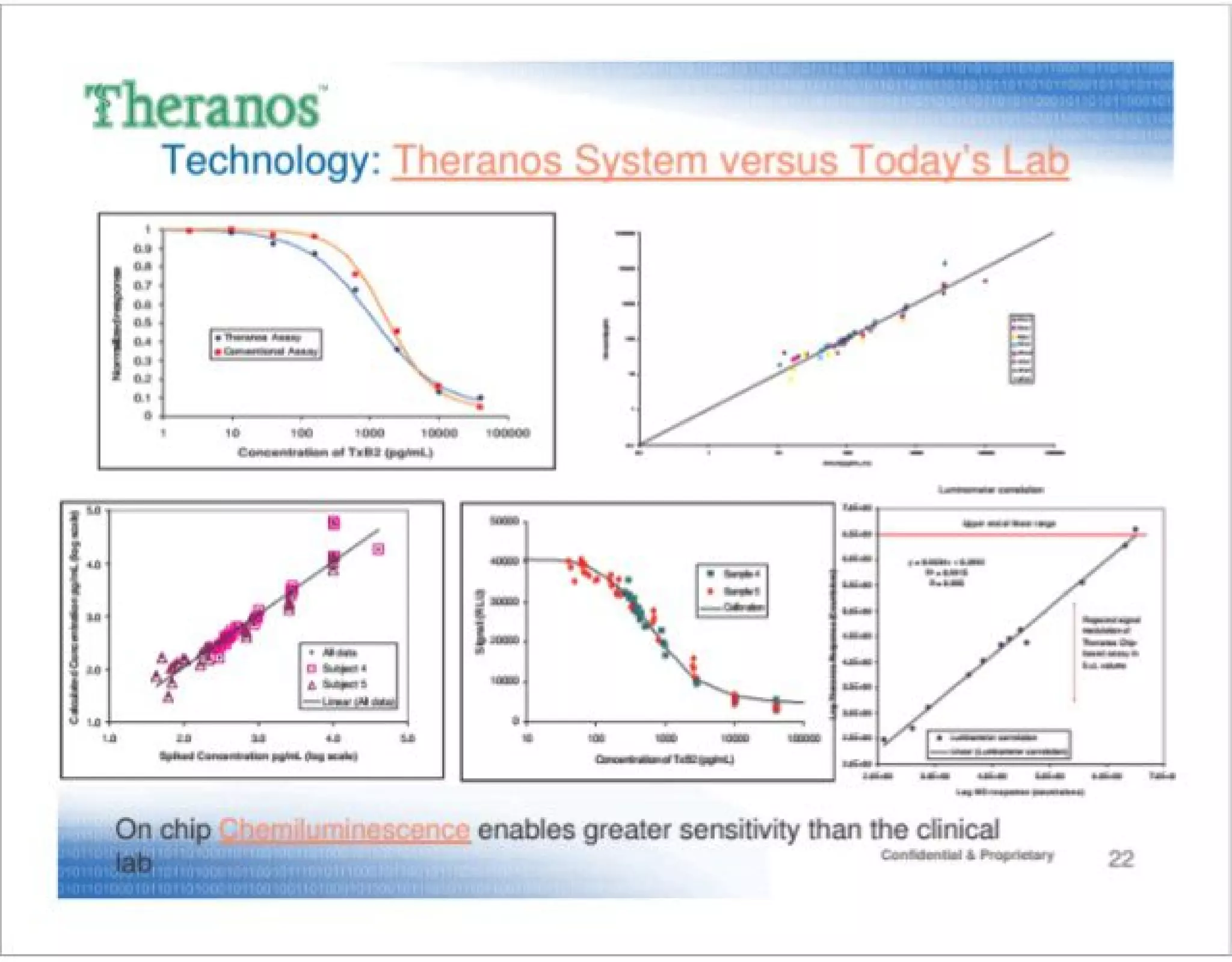

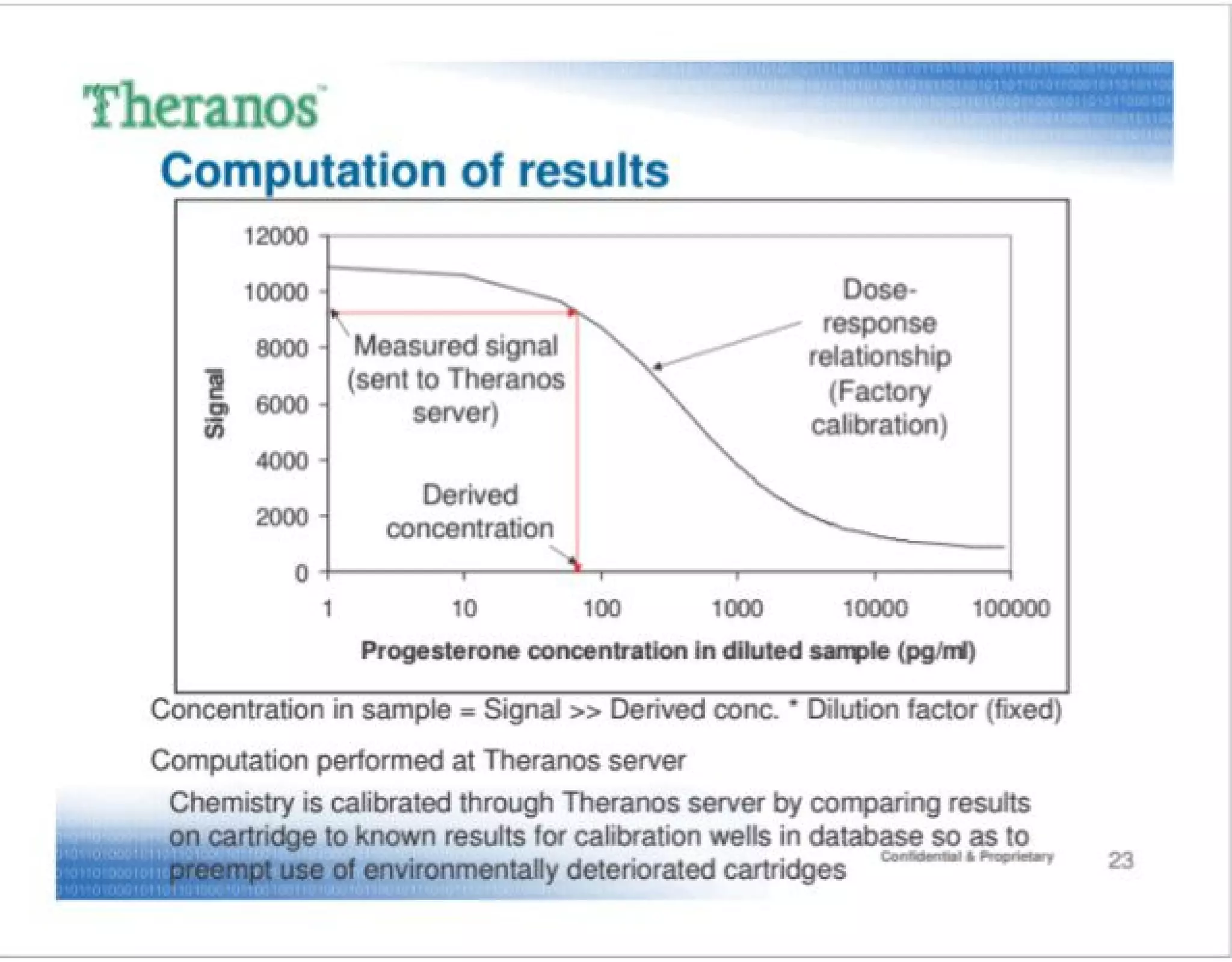

Theranos’s Series C deck is a strong example of investor-focused storytelling: clear branding, a defined beachhead market, tangible product visuals, succinct technical claims and ambitious market math. These are the right elements for a hardware/diagnostics raise and helped Theranos raise large sums quickly. However, the deck also illustrates critical pitfalls: grand claims without transparent, reproducible validation, optimistic TAM/conversion assumptions without conservative scenarios, and over-reliance on reputation rather than demonstrable, auditable performance.

For founders: craft a crisp narrative that ties product, market and monetization together; use visuals and a team slide to build trust; but pair every performance and market claim with verifiable evidence (protocols, blinded comparisons, regulatory milestones, and third-party data). Be conservative in your financial assumptions, transparent about use of funds, and ensure governance and data integrity are front and center — those are the factors that protect investors and founders alike as a company scales.