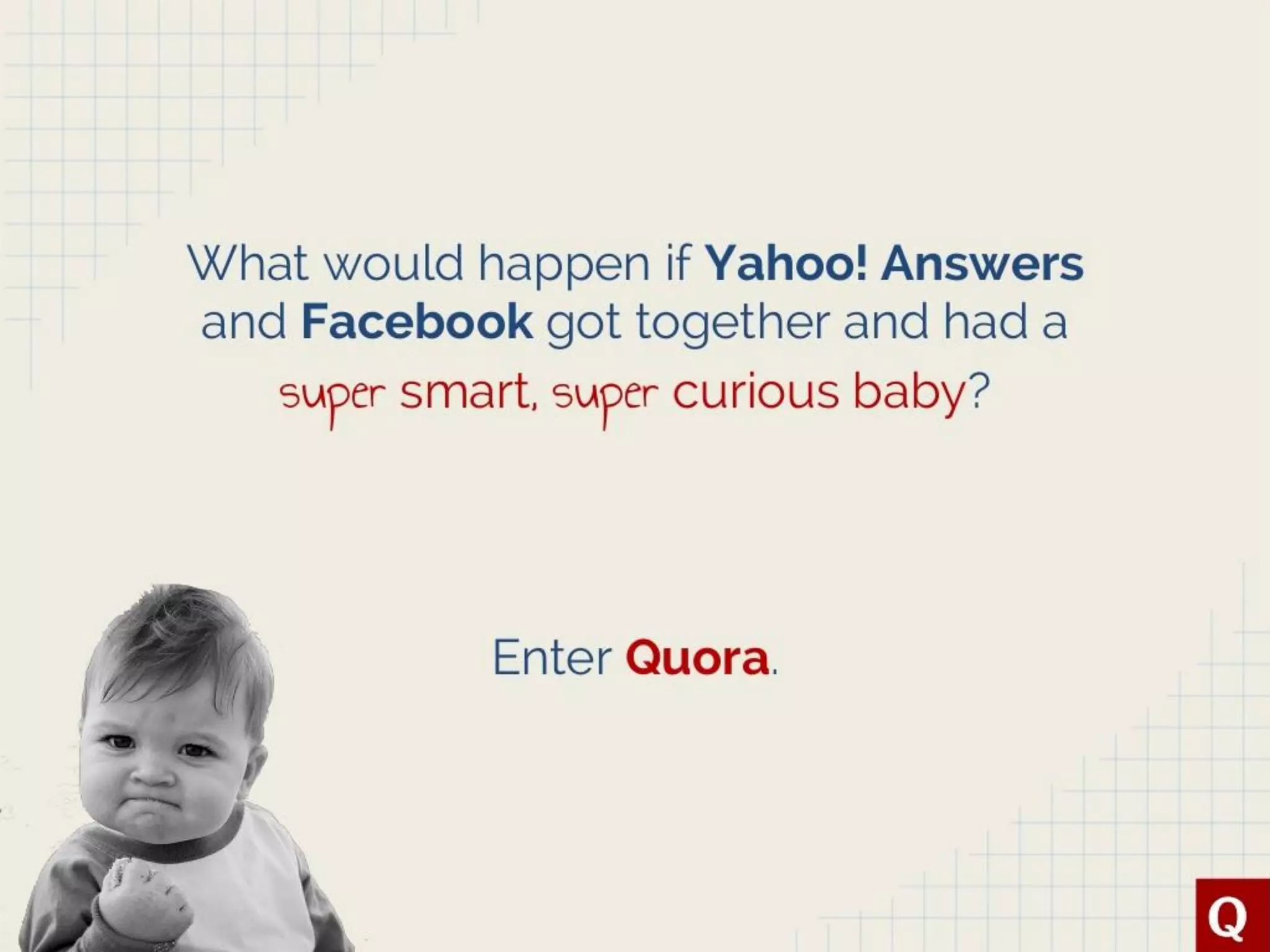

The Opening: Clear, memorable positioning

Slide 1 opens with a simple, memorable hook: “What would happen if Yahoo! Answers and Facebook got together and had a super smart, super curious baby? Enter Quora.” The line quickly conveys what Quora is by referencing two well-known comparisons rather than relying on abstract product language. Paired with a striking, viral-friendly baby image, it creates an easy-to-repeat narrative investors and press can use to describe the company.

This is effective because it reduces cognitive load for the audience and provides an emotional hook. Founders can learn to use analogies that map to familiar products to position new ideas quickly, and to pair that positioning with a simple visual that reinforces the message.