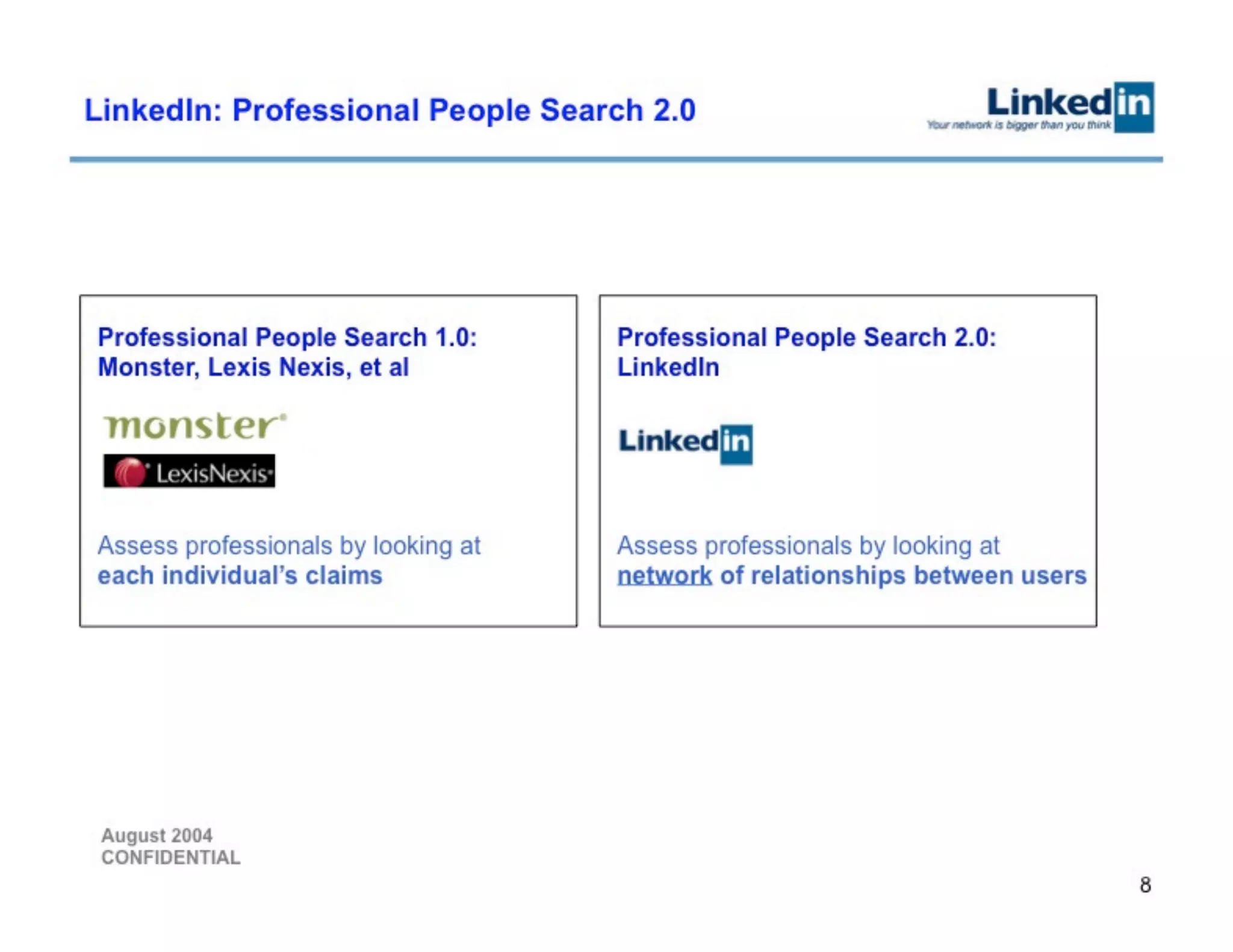

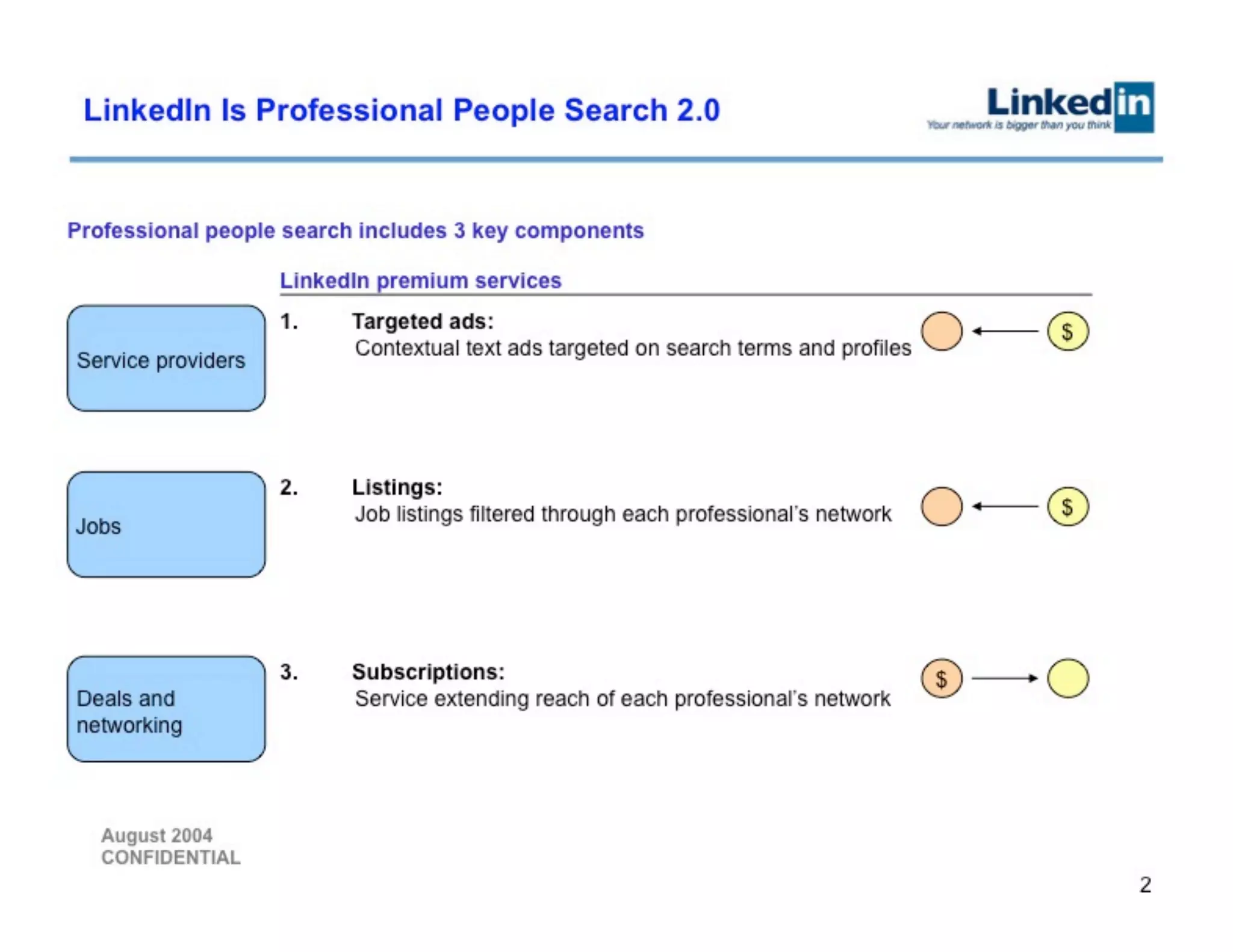

Value proposition: Professional People Search 2.0

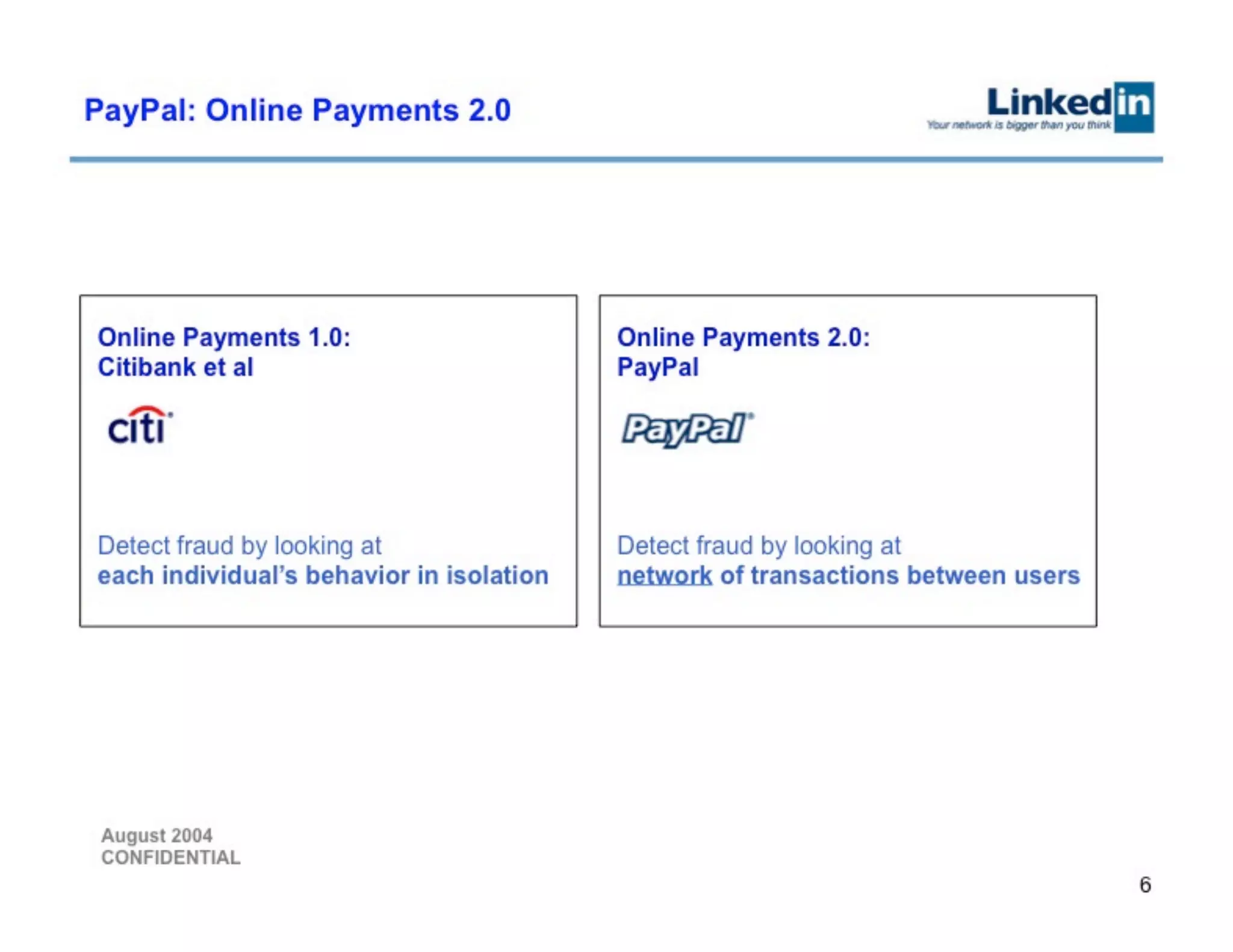

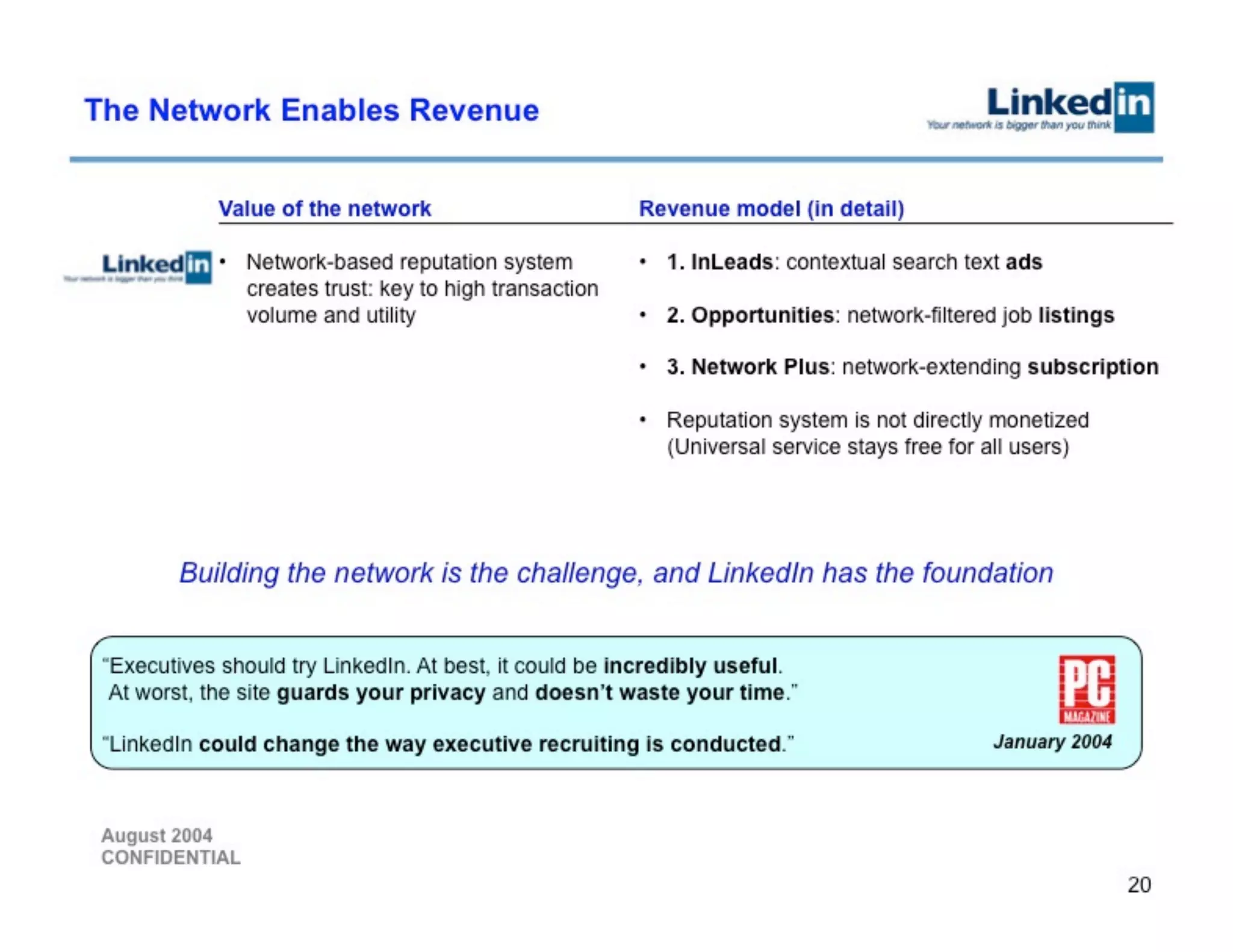

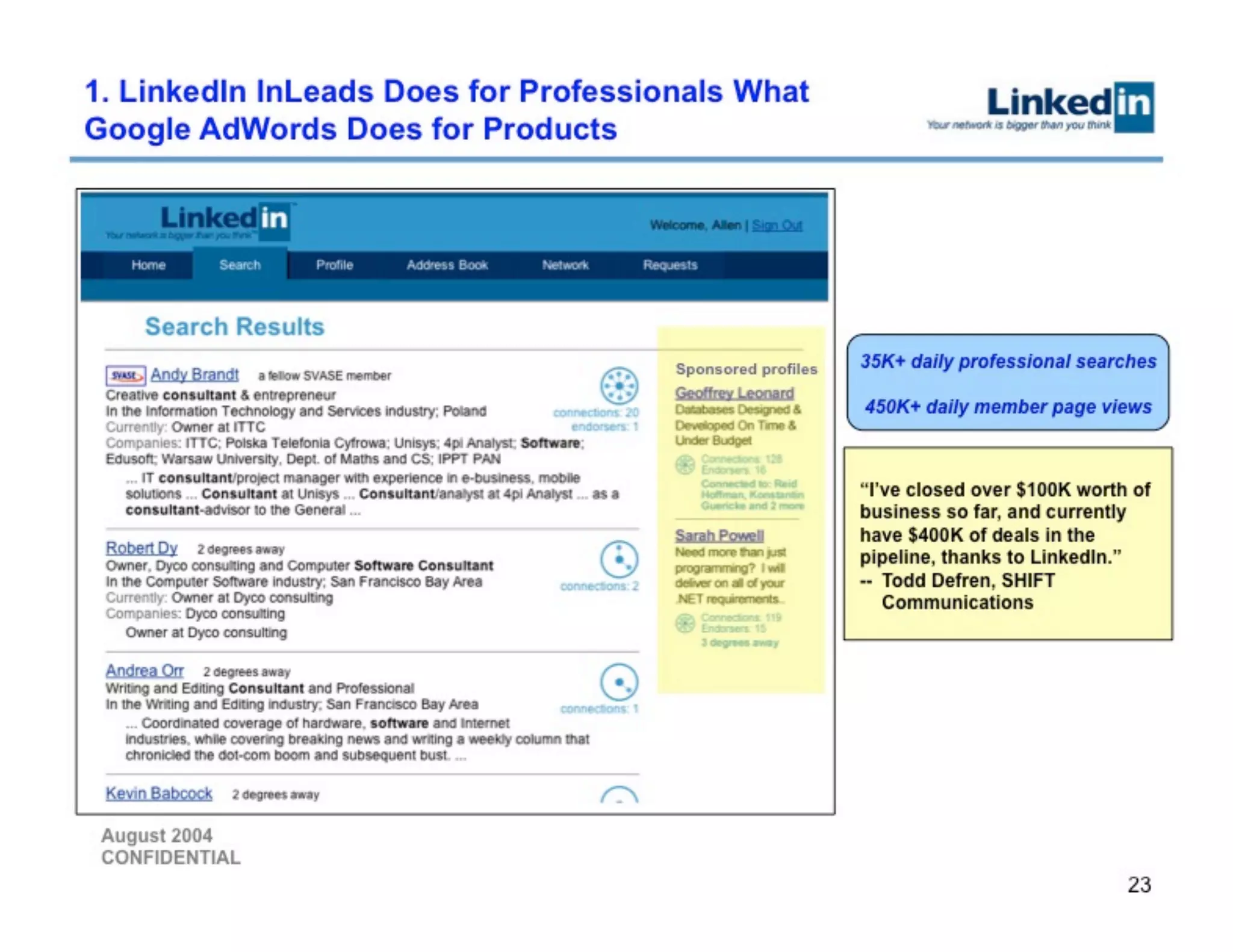

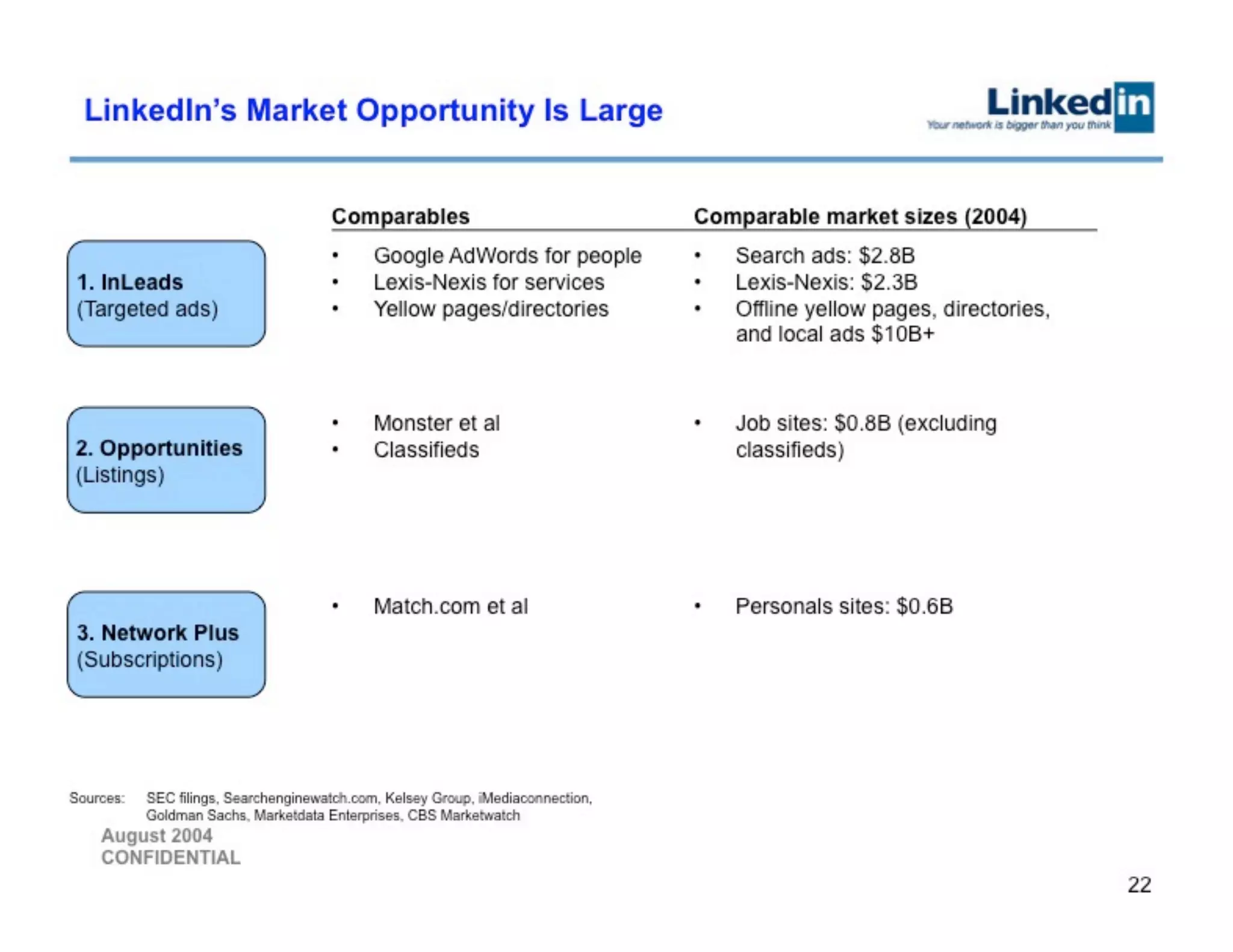

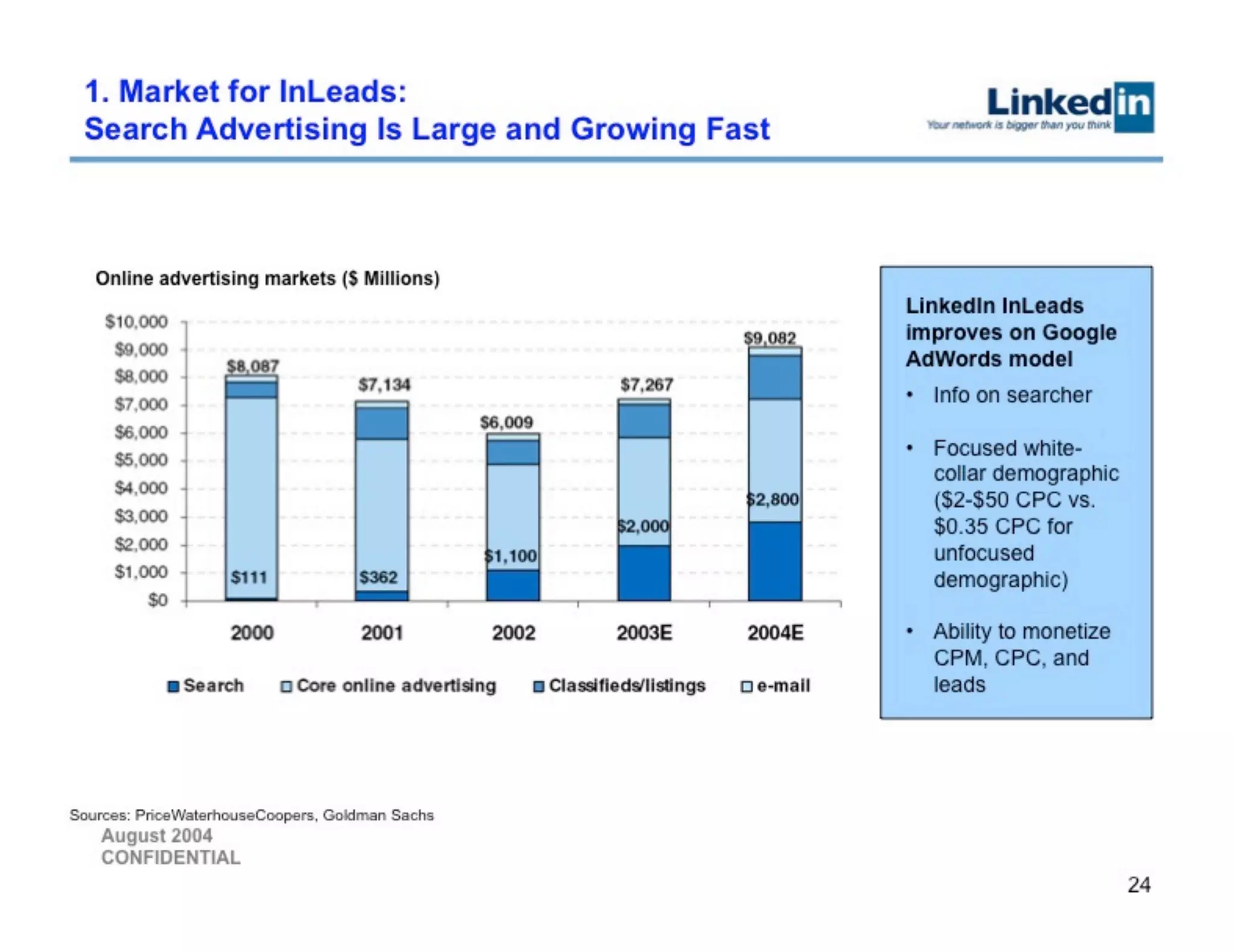

Slide 2 succinctly defines LinkedIn's product thesis: transform people search by using professional networks rather than flat directories. The slide is effective because it states the three revenue levers (targeted ads, job listings, subscriptions) while anchoring them to user value categories (service providers, jobs, deals and networking) — tying monetization directly to product utility.

Founders can learn from the clarity here: begin with the customer problem, show how your product uniquely solves it, and then map each major monetization channel to the user experience it extends. That reduces investor suspense and shows you understand both product and business model alignment.