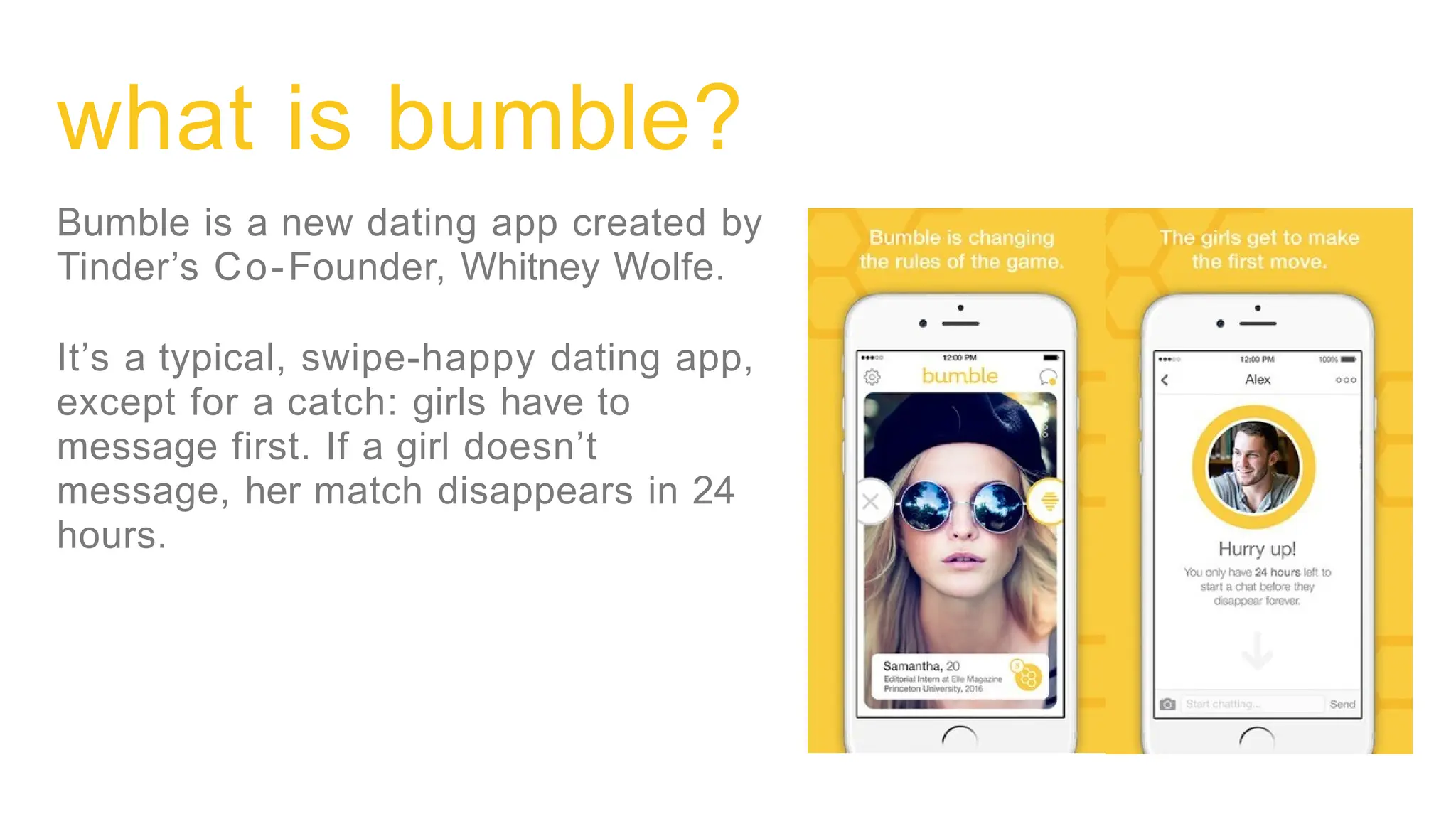

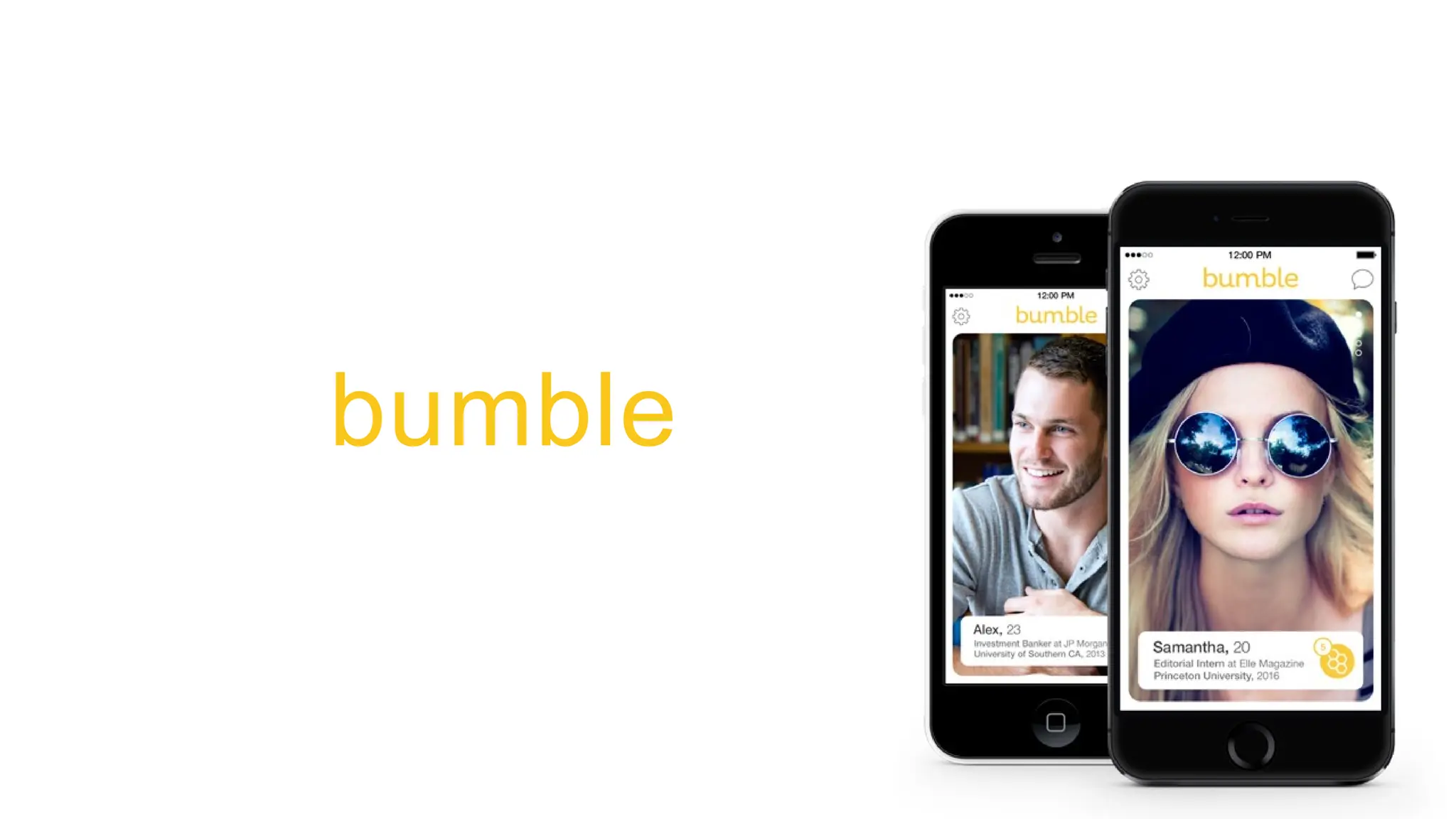

Cover / Brand Positioning

The opening slide (clean Bumble wordmark with phones showing the app) functions as a lightweight brand moment: it immediately establishes the product category (dating app), the visual identity (yellow, modern), and shows real UI and user photos. That combination of logo + UI gives investors instant clarity on what the company does and what the product looks like without needing text-heavy explanation.

This is effective because it trades exposition for visual clarity. Founders can learn that a strong, uncluttered cover that communicates category, brand, and product imagery builds immediate credibility and sets the tone for a marketing-focused pitch. It primes reviewers to focus on positioning and growth rather than technical complexity.